Between trade wars, geopolitical drama, and good old-fashioned “who owns what” anxiety, foreign farmland ownership has become a hot topic. Politicians are fired up. Farmers are curious. And everyone seems to have an opinion.

In which parts of the country do foreign investors own farmland? What’s behind their continuing investment in acquiring more and more of it? And is this a cause for legitimate concern over our national security? Let’s dig in…

How much land are we working with?

America is big. Like, 2.3 billion acres big—and that’s not even counting our lakes and rivers.

Here’s the breakdown:

- 29% is pasture and rangeland (hello, happy cows)

- 29% is forests (trees for days)

- 17% is actual cropland (smaller than you’d think, right?)

- 14% is parks and special uses

- 3% is urban (yes, really—just 3%)

Point being: we’ve got land. Lots of it.

How much do foreign investors actually own?

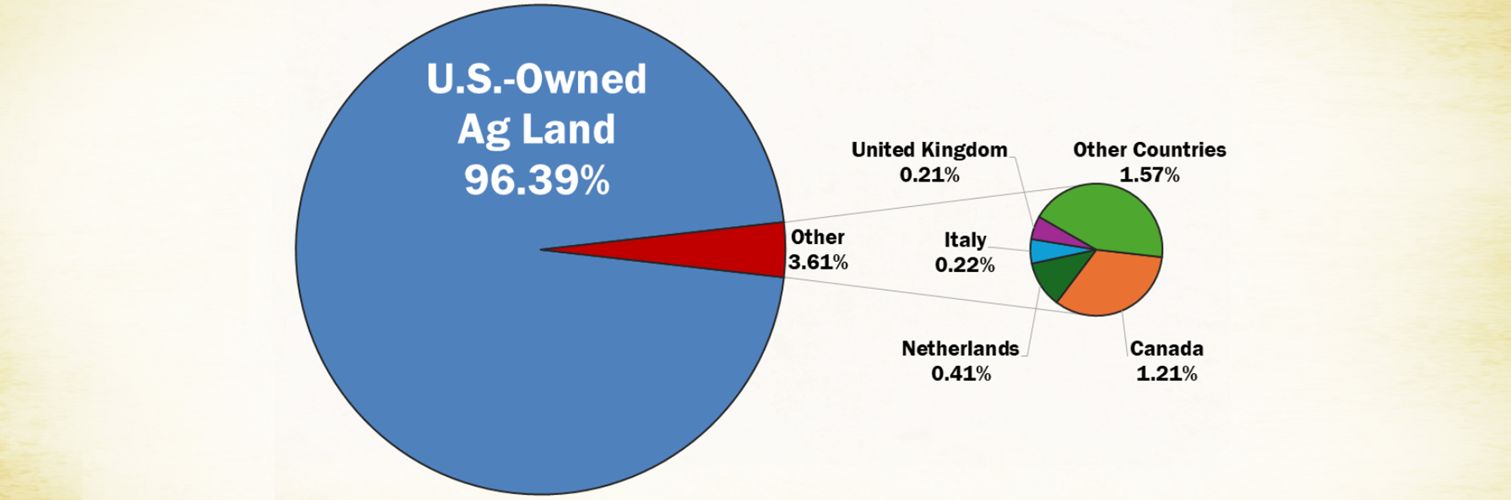

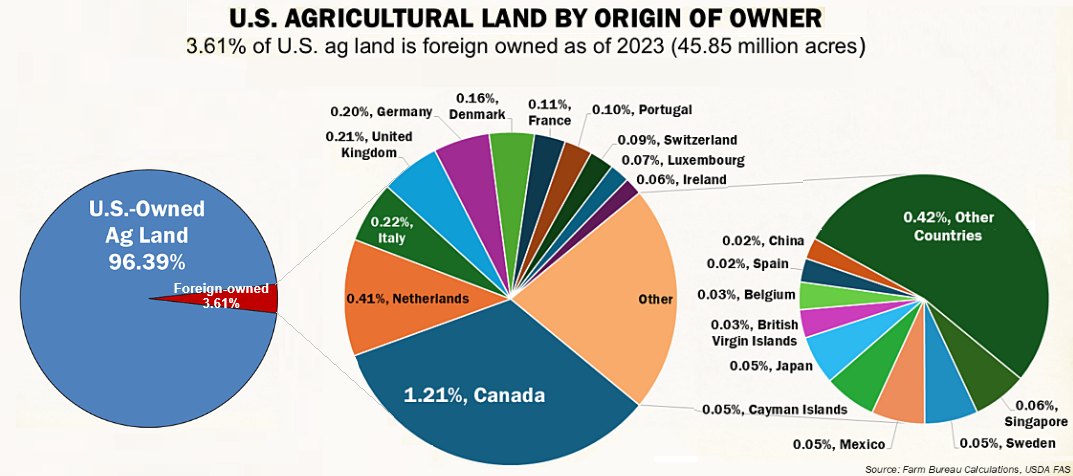

Ready for this? About 45 million acres—which sounds massive until you do the math. That’s roughly 3.5% of all privately owned agricultural land.

To put it another way: if U.S. farmland were a 100-slice pizza, all foreign owners would have about three and a half slices. Of that meager share, Canada, Europe and the UK combined get two slices all to themselves. The rest? Still very much American-owned.

That said, foreign ownership has been growing—about 2.6 million new acres per year since 2017, and it doubled between 2009 and 2019. So it’s worth paying attention to.

Plot twist: Canada is the biggest foreign landowner

Wait, what? Yep—our polite northern neighbors own roughly 13 million acres of U.S. farmland, worth about $12.5 billion. That’s 29% of all foreign-owned agricultural land.

Add in the Netherlands, Italy, Germany, and the UK, and you’ve got another 33%. The remaining third is spread across nearly 100 countries.

But what about China?

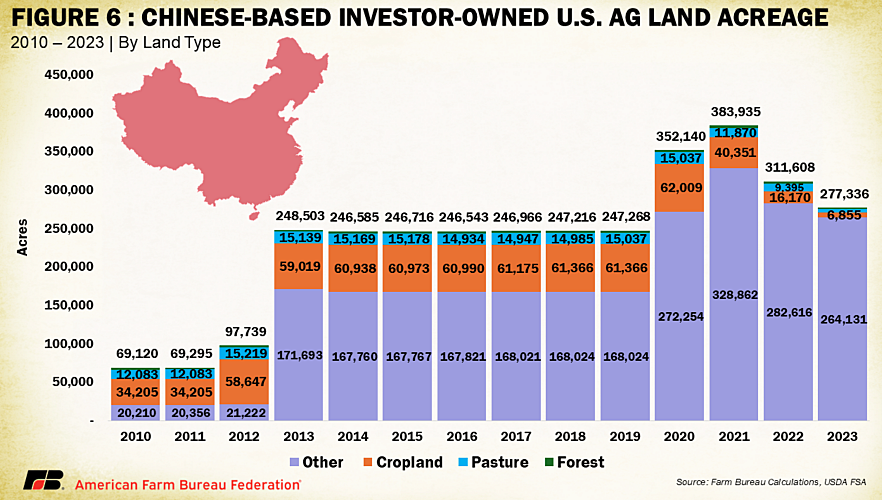

Ah yes, the elephant in the room. Despite all the headlines, China owns about 275,000 acres…less than 1% of foreign-held farmland. They’re in 30 states, with investments worth just over $1 billion.

That’s not nothing, but it’s also not the agricultural takeover some folks imagine. And interestingly, with U.S.-China tensions rising, reports suggest China is increasingly looking elsewhere for farmland investments—and pivoting toward ag-tech instead.

(Though yes, the Smithfield Foods acquisitions—128,000+ acres in the Dakotas, North Carolina, Virginia, and Texas—did raise some eyebrows.)

Location, location, location

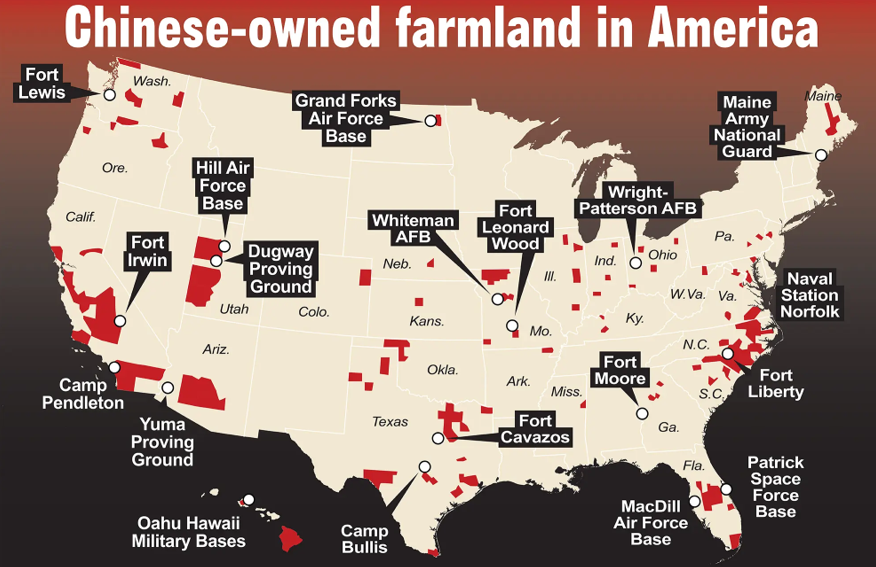

Here’s where things get spicy. It’s not just how much land foreign investors own—it’s where.

U.S. officials have flagged concerns about foreign-owned land near military bases and critical infrastructure. FBI Director Christopher Wray has called China a “grave threat,” warning that hackers have positioned themselves in U.S. systems, ready to “deal a devastating blow.”

That’s why proposals like Senator Josh Hawley’s “Protecting Our Farms and Homes from China Act” keep popping up—and why the Trump administration floated the idea of actually clawing back some existing Chinese land holdings.

What’s being done about it?

The government’s been tracking this since 1978 through the Agricultural Foreign Investment Disclosure Act, which created an obligation for investors to provide certain information about their investments to the U.S. Department of Agriculture.

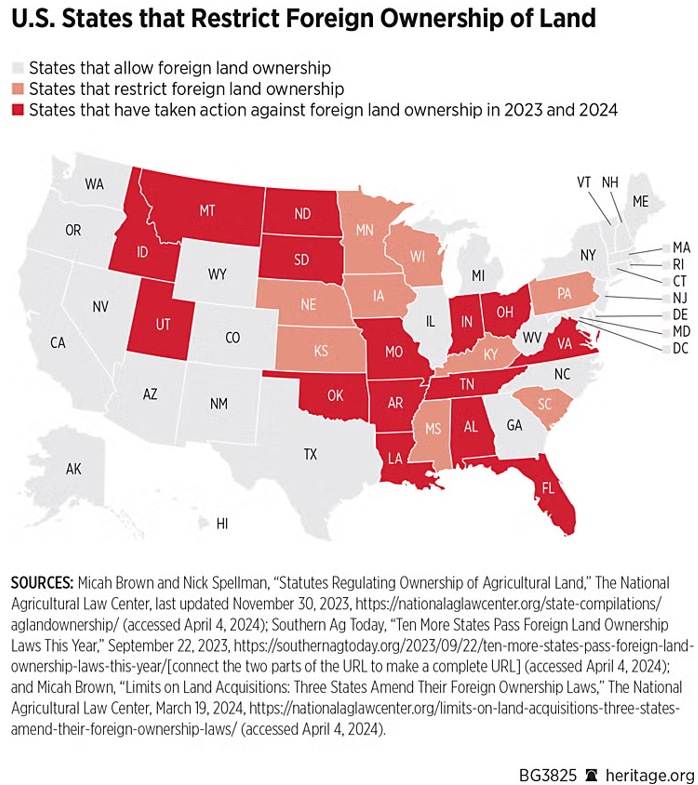

Although no federal law prohibits foreign ownership of private U.S. farmland, legislators at both the federal and state levels have proposed laws to monitor, restrict or prohibit such purchases if deemed to be counter to the best interest of their constituents.

Although no federal law prohibits foreign ownership of private U.S. farmland, legislators at both the federal and state levels have proposed laws to monitor, restrict or prohibit such purchases if deemed to be counter to the best interest of their constituents.

At present, such laws and regulations are in effect in 29 states.

Meanwhile, the Committee on Foreign Investment in the United States reviews foreign investments for national security risks. Last year, they expanded their jurisdiction to include 59 additional military installations.

Translation: Washington is watching.

Why do foreign investors want U.S. farmland anyway?

Simple: it’s a phenomenal investment.

The U.S. has one of the most productive, innovative agricultural systems on the planet. For countries thinking about food security, owning a piece of American farmland is like buying blue-chip stock. Even if they’re not shipping crops home, the land generates income through production, leasing, or resale.

Plus, it’s a living laboratory for agricultural innovation—techniques and technologies that can be exported worldwide.

There’s also growing interest in land for renewable energy—solar farms, wind installations, you name it.

And let’s be honest: the U.S. economy is stable, our financial systems are reliable, and our land isn’t going anywhere. For long-term investors, that’s pretty hard to beat.