Today, the weight loss drugs highlight a consumer movement against processed and ultra-processed foods. These foods have added ingredients such as sugar, salt, unhealthy fats, and artificial colors that provide no nutritional value…except great taste.

Eaten as an indulgence, they are not terrible. But, unfortunately, many people indulge in these treats as a dietary staple.

The Search for Nutrition

Consumers today are looking for nutritious foods. Foods that not only treat existing diseases but prevent ones from appearing. Foods that help you manage your health and help you age gracefully, with ‘food as medicine’ the sought-after goal.

Innova Market Insights identified nutritional value and balanced nutrition, along with naturalness are important for consumers.

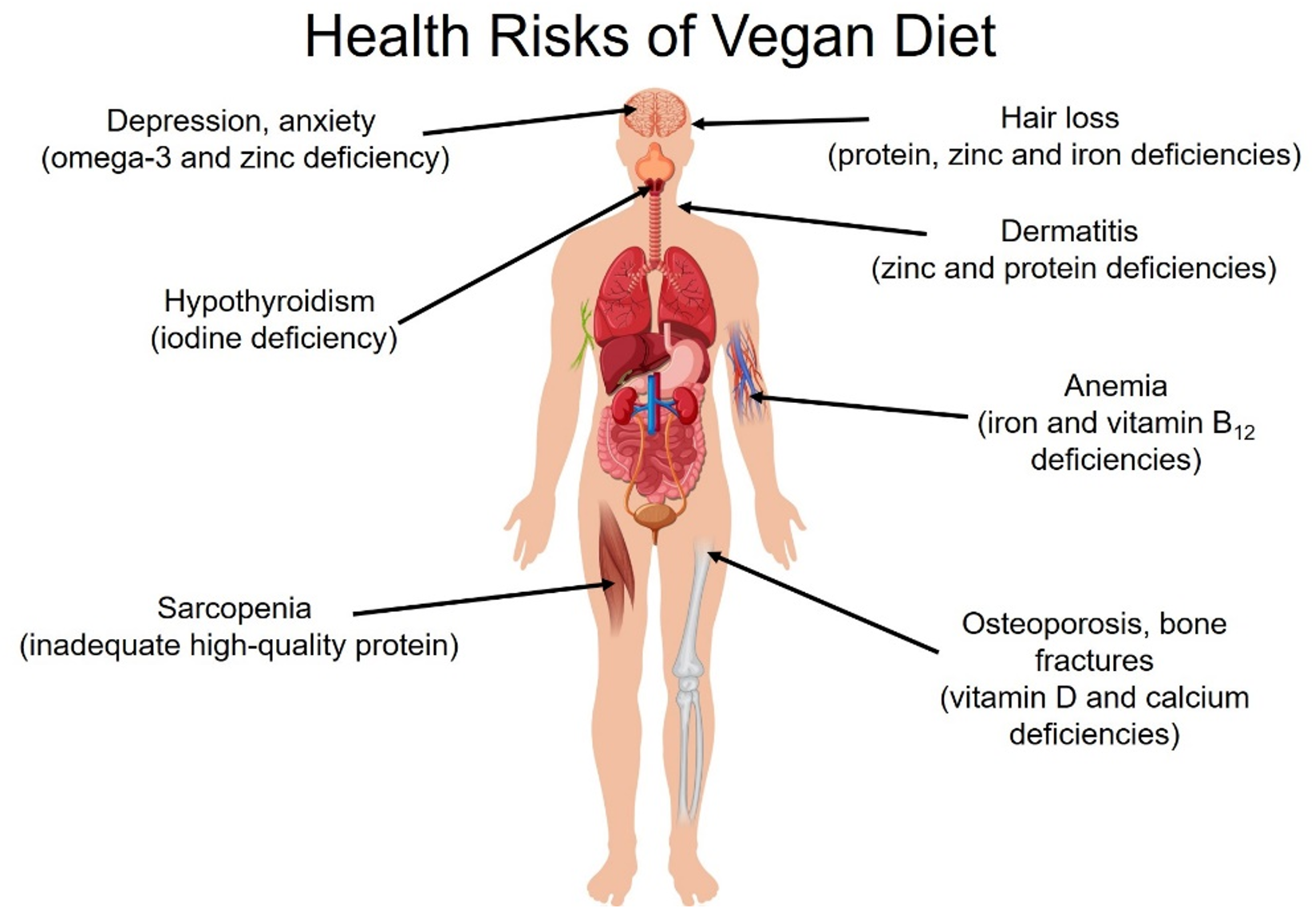

Ingredients containing protein, Omega-3, fiber, vitamins, prebiotics, probiotics, and even esoteric mushrooms such as ashwagandha and lion’s mane are high in demand. Mintel also identified a changing attitude toward extending life in good health.

How GLP-1 Drugs Affect Our Diet

Further fueling demand for a healthier, more nutritious diet are among those taking a new class of prescription drugs: GLP-1 agonists. These medications, like Ozempic and Wegovy, help lower blood sugar levels and promote weight loss.

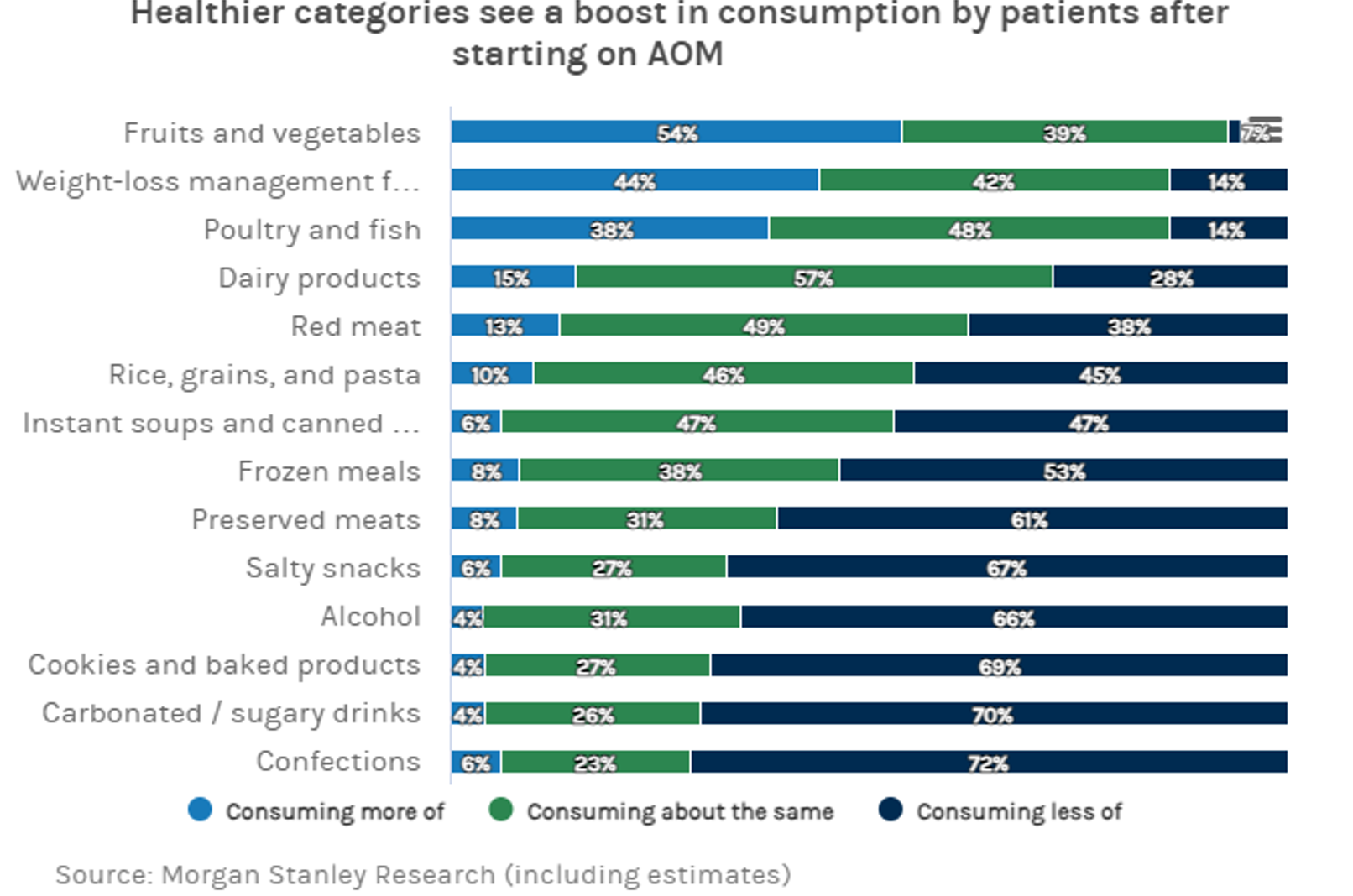

Morgan Stanley’s research survey of 300 patients taking a GLP-1 agonist found that these drugs reduced their daily appetite by 20-30 percent. They lost their appetite for candy, sugary drinks, and baked goods, creating room for adding healthy foods to their diet.

Especially as those on the GLP-1 drugs are not that hungry and might not meet the full 2,000-calorie minimal daily requirement, it is essential that what they do eat in a day provides their full complement of minerals and vitamins.

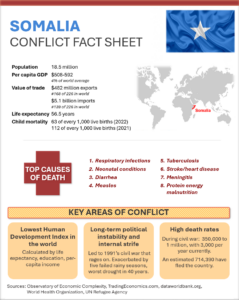

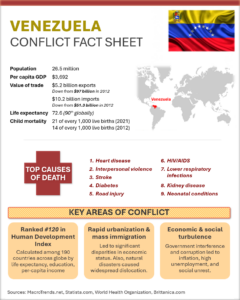

As the obesity epidemic continues to rise, so will the associated health issues such as heart disease, type 2 diabetes, certain cancers, and fatty liver disease.

Today, about 69 percent, or 178 million adults, are either overweight or obese. Adult obesity is at 42.4 percent and is expected to climb to 50 percent in just six years.

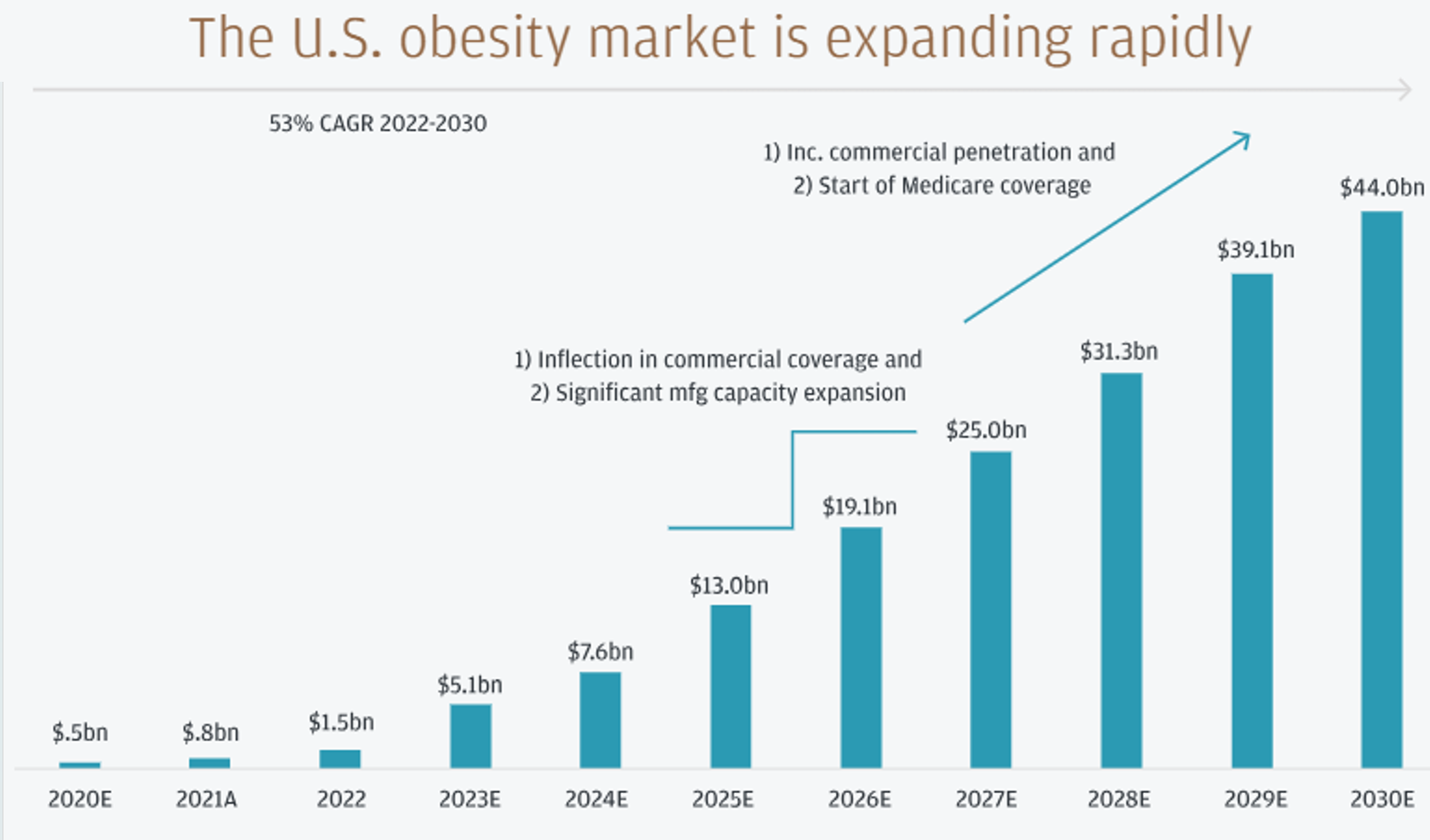

GLP-1 drugs seem to hold the answer to obesity, heart disease, and diabetes. Morgan Stanley estimated that 7 percent of the U.S. population will be take GLP-1 medications by 2035. This equates to a potential $44 billion market by 2030.

Will Food Sales Decline?

Grocers and consumer products companies worry about the future if more and more people are cutting 20-30% of their calories out of their diet.

In the fall of 2023, Walmart announced that it had seen a slight drop in food demand due to appetite-suppressing medications. It might be too soon to tell given that there is such a small percentage of the population on these weight loss programs, but as the numbers increase, how will CPG companies prepare?

However, CPG companies and grocers can benefit from this trend; consumers don’t have to be hurt by purchasing less food. Of course, if everyone ate more fruits and vegetables and fewer cookies, then obesity would not be an issue.

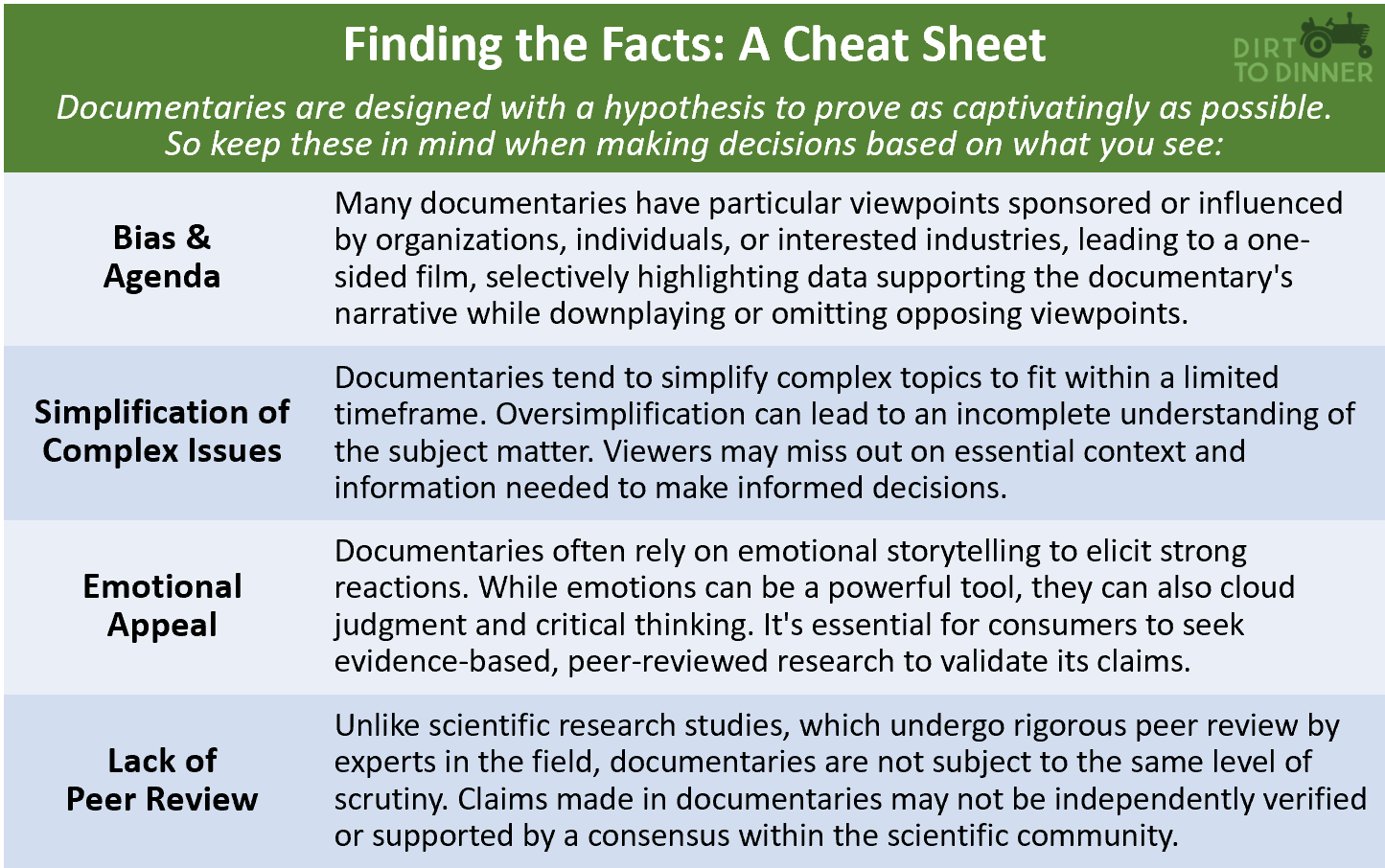

At D2D, we have written about changing one’s diet, but it is hard. What you eat is what you crave. Can anything be done to meet our nutritional needs while sating our tastebuds?

How about a Healthy Oreo?

There are over 14 unique Oreos to choose from, with ‘Double Stuff’ being our favorite, mostly because it is reminiscent of our childhood.

But sadly, there is no benefit to eating these every day. Despite their great taste, they have no nutritional value, 12 grams of sugar, and 150 calories for just two cookies. They would be considered an indulgence and not a ‘food’.

What if the Oreo had the same basic ingredients but with added health benefits?

What if the creamy filling included Omega 3s for heart health, and fiber in the cookie for lowering cholesterol, aiding gut health, and reducing the risk of heart disease? Some vitamins like D3 could be added as an extra immune benefit. Instead of sugar, there could be stevia to keep the taste.

The mouthfeel and taste that any saturated fat provides could be replaced by an alternative fat from a plant oil called Epogee.

To be fair, in 2021, Mondelez did try to launch the Oreo Zero in China. Instead of sugar, they used sucrose and glucose, which gave a different taste from the original Oreo. They chose China because those consumers like less sugar in their snacks. Needless to say, it was not a success. Some of you readers might remember the backlash against the ‘New Coke’ in 1985. A change in the 99-year formula was a complete flop because Coca-Cola lovers liked the ‘Real Thing’.

How can CPG Companies Benefit?

But are CPG companies ready to make such big changes? Already, many are starting to address their concerns about the potential for declining food consumption.

According to Food Dive, Coca-Cola and PepsiCo have introduced small cans in response to consumers cutting back on sugar. Also, snack companies have created 100-calorie small snacks. Some have reduced salt and others have reformulated their products for added nutrition. But is it the right answer?

CPG companies have a range of opportunities to create healthier products. These changes can have meaningful impacts on consumer health.

How can the pharmaceutical industry influence the snack industry?

Healthier Product Formulations:

- CPG companies can reformulate existing snacks to align with healthier profiles. For instance, reducing added sugars, saturated fats, and sodium content.

- Whole grains, fiber, and protein can be added in to create more satisfying and nutritious snacks.

- CPG companies can focus on nutrient-dense options that provide sustained energy.

Functional Ingredients:

- Incorporating functional ingredients like prebiotics, probiotics, Omega-3, turmeric, and additional antioxidants can enhance the nutritional value of snacks.

- GLP-1 users may want to seek snacks that support gut health and overall well-being.

Portion Control and Mindful Snacking:

- Ozempic’s appetite-suppressing effects may encourage consumers to eat smaller portions.

- CPG companies can develop snack packs with smaller, healthier portions, promoting mindful eating.

- GLP-1’s impact on cravings could lead to decreased consumption of empty-calorie snacks (e.g., sugary treats).

Marketing Strategies:

- Highlighting diabetes-friendly, weight-conscious, or blood sugar-friendly snacks can resonate with GLP-1 users.

- Transparent labeling and clear health benefits can attract health-conscious consumers.

Collaboration with Healthcare Professionals:

- CPG companies can collaborate with healthcare providers to educate consumers about healthier snack choices.

- Ozempic users may appreciate guidance on suitable snacks to complement their treatment.