The Harris/Waltz campaign promises to bring down American’s grocery costs. One of their strategies is to pass the ‘first-ever federal ban on price gouging.’

Price gouging is, in times of short supply or inflation, companies, or individuals, raise the price of their goods above and beyond what is fair and economical. For instance, during Covid, some people bought personal hand sanitizer dispensers for $1.00 and resold them for over $7.00. Or, during an inflationary period when prices are rising, companies charge more than their basic profit margin.

Many states already have ‘price gouging’ laws that prohibit ‘excessive’ or ‘unconscionable’ prices in the wake of a declared emergency, such as a hurricane or other natural disaster. These laws purport to protect consumers against companies’ exploiting a surge in demand for necessities, including food and energy, caused by an emergency.

Whatever the merits of those laws, they appear to be quite different than the generalized price controls proposed by the Harris/Waltz campaign.

Price Controls in a Global Food System

Price controls are not a simple solution. If uncontrollable costs increase the price of food, then food producers and consumer product companies will suffer because their goods sold have to remain competitively priced.

Because countries are interdependent on each other for food prices, what happens around the globe reverberates to the grocery aisle…

- a drought in Argentina can affect corn prices in the U.S. because there is less global corn available,

- the price of your chocolate dessert has increased because the Ivory Coast and Ghana governments raised the farmgate price for cocoa buyers, or

- the potential longshoreman strike could affect the price of your bananas or tomatoes coming in from Mexico or Holland.

The list of potential situations affecting the price of food in our grocery aisles is endless.

Price Controls in Your Neighborhood

Let’s take a simple example of a lemonade stand to demonstrate pricing controls. Your children want a new iPhone, and you tell them that they need to earn it themselves. One hot sunny summer day, your son and daughter decide to create a lemonade stand to keep your neighbors cool and hydrated. “Our lemonade will be unique”, they said. “It is sugar free and has electrolytes.”

You help fund a big table, two chairs, lemons, electrolyte powder, stevia for sweetness, plastic cups, and a blender for mixing. You calculate that if they sold 100 cups of lemonade, they could charge their customers $1.25 per drink. That way, they would cover their costs of $0.75 a cup and make a 50-cent profit on each cup. If they sold all 100, that would be $50 for the day. In a little over two weeks throughout the summer, they would have the new iPhone in time for school.

You walk around the neighborhood and see that other neighbors also have lemonade stands, each with unique features, such as cinnamon, hot chilies, or even icy slushy blueberries and strawberries in their drinks. But you notice that the lines are longer around some and see that many prices are only $1.00 a cup.

You wonder: are your children charging too much? So you go back and encourage them to drop their price to $1.00, knowing that at least they should make $25.00 for the day. This will take most of the summer, but an iPhone is still in their future. Life is good.

You wonder: are your children charging too much? So you go back and encourage them to drop their price to $1.00, knowing that at least they should make $25.00 for the day. This will take most of the summer, but an iPhone is still in their future. Life is good.

And here come the price controls: the town government decided that the lemonade around the neighborhood is too expensive. Thinking it is helping those who cannot afford to pay $1.00 a cup, the town puts a ceiling of $0.70 a cup. This creates a loss for everyone whose cost is about the same at $0.75 a cup. The lemonade vendors, your children included, fold up their chairs and that is the end of neighborhood lemonade.

The government goes back to reconsider their price ceiling and decides to help the lemonade vendors. They increase the ceiling to $0.90. They also put in a price floor of $0.80. With a small profit margin realized, a few optimistic lemonade vendors are back in business. Your children are hanging in there.

Suddenly there is frost in Florida and the price for lemons have doubled. The price floor doesn’t help as the lemonade vendors have a higher cost of goods than they can sell on the market. Their cost to produce lemonade is now $1.25. This is way over the price floor of $0.80 and over the price ceiling of $0.90.

Lemonade is now a nostalgic memory. There will have to be plan B for an iPhone.

Price Controls Gone Awry

On a much more serious scale, here is what happened when governments tried price controls in Venezuela, Russia, and even in the United States.

Hint: It didn’t work then, either.

Price controls are often associated with Communist countries, as it involves more government intervention than Western Democracy often practices. Despite the best intentions to maintain cheap prices, history has shown that price controls tend to backfire with severe shortages of consumer necessities across a nation.

Venezuela

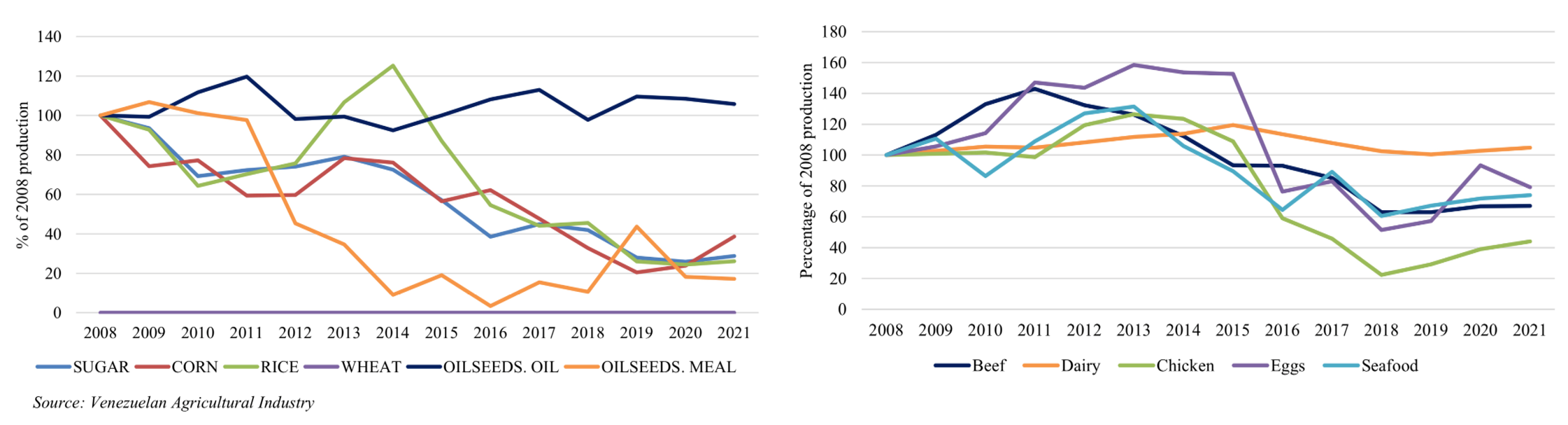

Venezuela struggled during the 2008 commodity and financial crisis and due to price controls and overall poor governance, they have still not recovered. In 2008, due to weather, crop shortages, and oil prices, global prices for rice and wheat escalated by over 200% and 100%, respectively.

President Chavez announced, “there is a food crisis in the world, but Venezuela is not going to fall into that crisis”. He passed the Law for Fair Costs and Prices which put price ceilings, floors, and audits on companies.

Like the lemonade stands, many of these companies went out of business due to negative margins. As a result, production dropped, food availability on the grocery shelves suffered, and there was a significant food crisis.

The number of undernourished people escalated to 6.5 million in 2020 from .7 million in 2013. Venezuela has still not recovered As of June 2024; it is estimated that there are 550,000 Venezuelan’s who have migrated to the U.S.

It is no wonder. Their Global Food Security Index score is 106th out of 113th in the world, and is ranked 18th out of 19 South American countries. Only Haiti is below them.

Soviet Union

In the 1980s, President Mikael Gorbachev, had good intentions to keep food and consumer goods prices low to ensure they were affordable for the public. Gorbachev implemented price controls as a staple economic policy aimed at stabilizing prices and preventing inflation. However, these controls often led to significant issues, notably shortages of goods and a decline in product quality.

One of the main reasons these controls failed was that the fixed prices didn’t reflect the actual costs of production. Companies and producers of food lost their incentive to supply the grocery store when they had a loss. This led to empty store shelves. The black market flourished because people had to eat and went to the black market which set its prices based on basic economic supply and demand. It ended up undermining the state price controls.

Gorbachev caved and he removed controls and settled for a basic market economy. Then, when price controls were lifted, there was hyperinflation, and prices rose by over 2,000%! There is nothing quite as predictable as basic supply and demand for market efficiencies.

United States

If you were born in the 1960s, you will remember the 1970s gas shortage while trying to fill your car with gas. Once again price controls imposed by President Nixon didn’t work. There was a 1973 OPEC oil embargo and in response the U.S. government-imposed price controls to keep gas affordable for the customer.

However, these price caps led to unintended consequences. Gas prices were $0.36 a gallon. When going to parties, I remember contributing $1.00 for three gallons of gas. Of course, this was way below the cost of production, so the oil companies stopped producing oil because they lost money for each gallon of gas. This also prevented them from investing in new drilling or additional resources.

This also led to VERY long lines at gas stations and at-home stocking of gasoline.

Would History Repeat Itself?

“We economists don’t know much, but we do know how to create a shortage.

If you want to create a shortage of tomatoes, for example, just pass a law that retailers can’t sell tomatoes for more than two cents per pound. Instantly you’ll have a tomato shortage. It’s the same with oil or gas.”

― Milton Friedman, Nobel Prize-winning economist and statistician

While governments can be tempted to control the price, the complex relationship between government policies, producer incentives, and consumer needs shows that market dynamics reign and cannot be ignored.