GFMag.com

Tariffs: Economic Boost…or Negotiating Tool?

The Dirt

President Trump promised tariffs on goods entering the United States once again stand to have important consequences for our agricultural system – and ultimately food consumers. What’s behind this new round of trade combat, and what can we expect from it?

Global Food

Tariffs: Economic Boost…or Negotiating Tool?

The Dirt

President Trump promised tariffs on goods entering the United States once again stand to have important consequences for our agricultural system – and ultimately food consumers. What’s behind this new round of trade combat, and what can we expect from it?

What is Trump doing with tariffs?

Trump is using tariffs to bring jobs back to America, keeping illegal immigrants from crossing the Canadian and Mexican border, and preventing cheap Chinese exports from flooding the market.

During Trump’s first term, he imposed import tariffs on $380 billion worth of products. In recent remarks, he described a range of proposed tariffs being phased in at 2 to 5 percent per month during 2025. In his 2024 campaign, the Presidential candidate spoke of imposing a 10 to 20 percent tariff on all U.S. imports. Mexico and Canada – two of the United States’ largest trade partners, would face additional 25 percent tariffs, and China an additional 10 percent. This follows yet another threat to impose a 60 percent tariffs on goods from China.

Just recently, Colombia would not accept two planes full of deportees from the United States. President Trump threatened the Colombian government with tariffs on exports to the U.S.; Colombia then backed down and a trade war was averted.

What is a tariff and why do nations impose them?

A tariff is simply a tax that is imposed on goods entering or leaving a country. Tariffs may be imposed on exported and imported goods, although import tariffs are by far the more common practice.

They have been used throughout history for a variety of reasons – to raise revenues, or to protect a domestic industry or group from external competition or unfair trade practices.

In our modern world, tariffs have become a powerful lever in international diplomacy – an economic tool for winning concessions from other nations and achieving a greater “balance” in international relations.

President Trump appears to be motivated by all these considerations.

When used properly, they can level a global playing field by creating jobs at home, thus increasing the GDP per capita. For instance, in his first administration, President Trump threated Europe with tariffs if they implemented carbon and digital services taxes to U.S. industries.

As of January 22, 2025, President Trump said he would add new tariffs and sanctions against Russia if Putin refused to negotiate an end to the war with Ukraine. President Trump has also threatened tariffs against China to stop the fentanyl flow into the U.S.

Tariffs can be a valuable tool in driving U.S. economic growth. More expensive imports help domestic industry to rebound and grow, they argue, through expanded market opportunities. And when those industries grow, they generate more tax revenue.

When goods are taxed without a ‘higher purpose’ then they can be destructive and reduce economic value. If goods are taxed without better access to markets and security, then the consumer pays more without the benefits.

Regardless of the final scale of tariffs, it’s clear that they stand to become a factor in the U.S. and global economy.

What effects do tariffs have on buyers and on sellers?

Tariffs on imported goods are paid by the importer. The added costs of the imported goods are usually passed along to the consumer. For example, an analysis by the Public Broadcasting System (PBS) during the first Trump tariffs in 2018-2020 estimated the cost of the tariffs amounted to about $800 per household. The Federal Reserve and Congressional Budget Office placed the tab a bit higher – between $500 and $1,700 per household in 2020.

The latest proposed tariffs are estimated to have comparable, if not larger, effects on consumers. A study by the Peterson Institute for International Economics estimated President Trump’s tariffs would cost the average U.S. household about $2,600.

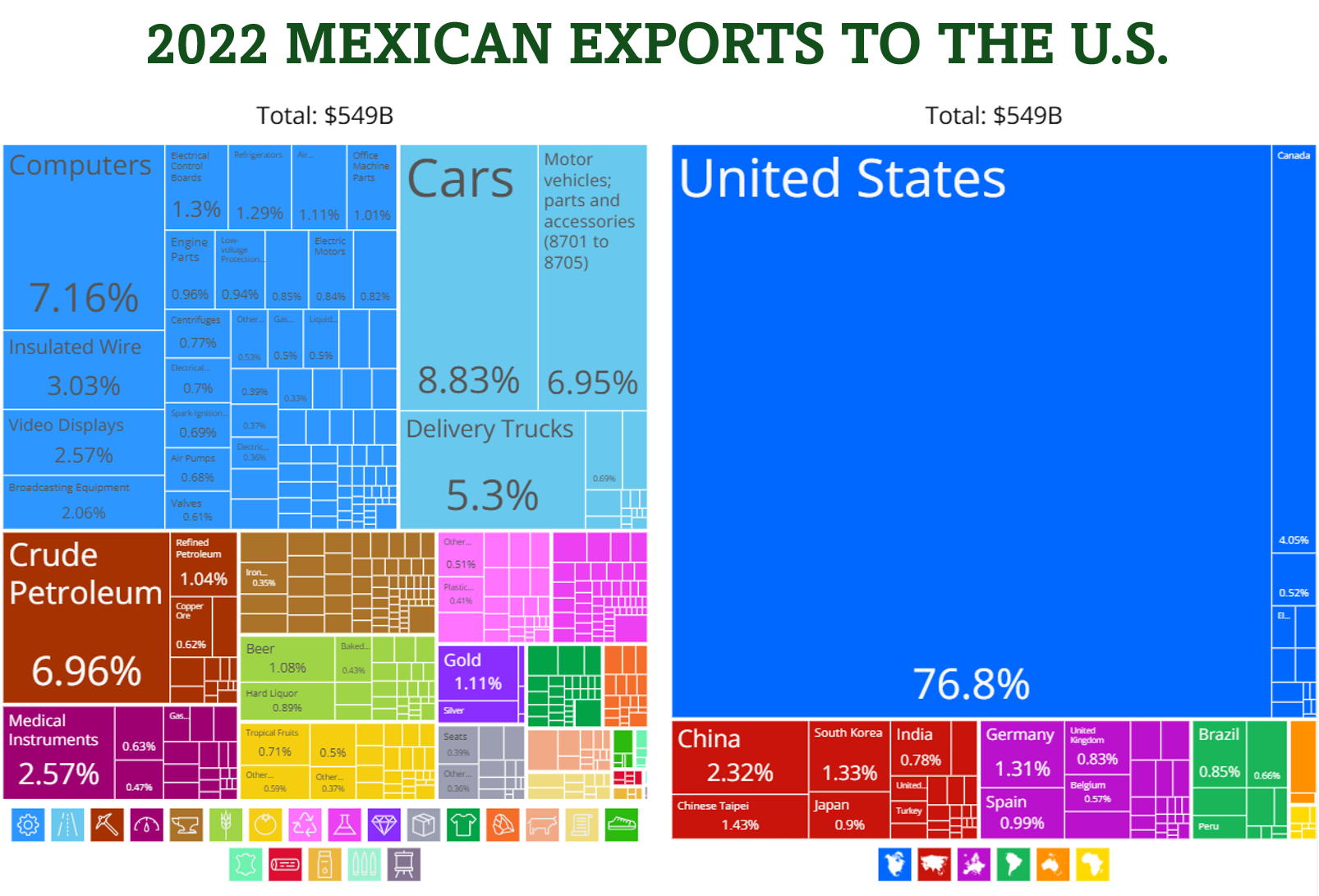

Let’s use the 25% tariff for Mexico and Canada as examples. They are the United States’ first and third largest suppliers of agricultural products. The EU is number two. To stem the tide of immigration, President Trump has announced that if the Mexican and Canadian governments don’t curtail illegal immigrants coming across the border, their exports to the U.S. will be that much more expensive. Mexico depends on the U.S. for trade. In 2022, 77% of their $549 billion in products were sold to the U.S.

For U.S. food consumers, the most immediate effect of higher tariffs would fall on foods we source from Canada and Mexico – notably fresh produce, fruits and vegetables, alcohol, grains, and some meats.

The U.S. has increasingly relied on imports for our fruits and vegetables. In 2023, the U.S. imported 55% of fruits and vegetables, up from 37% in 2000. The United States imports 34% and 73% of fresh fruits and vegetables, respectively in 2022.

But others in the food chain also stand to be affected. Food manufacturers (and retailers) who rely on foreign supplies of key ingredients face the tough choice of absorbing the higher cost – or passing some or all the higher costs on to consumers.

With the talk of tariffs still more speculation than fact, it is impossible to create any credible estimate of how much the proposed tariffs actually will raise food costs.

But what is known is that the Department of Agriculture already estimates food price increases of just under 2 percent for 2025 — lower than the historical average of 3 percent — with the largest cost increase coming for food consumed away from home.

That is before any tariffs are imposed.

Why should farmers and consumers care about new tariffs?

But consumers aren’t the only segment of the economy that stand to be affected. Just ask anyone on an American farm, or anyone else along our complex food chain from dirt to dinner.

U.S. agricultural exports to China in 2018-2019 fell by 76 percent, or roughly $25.7 billion, according to Statista, by most accounts due to a de facto tariff war. The US tariffs to China were put in place to protect US companies, but China retaliated by placing tariffs on US soybeans, sorghum and pork.

The effect could have been even worse were it not for a U.S.-China trade agreement that obligated China to purchase a $80 billion of U.S. agricultural goods. China only partly fulfilled its obligations (77%), it turned mainly to Brazil to supply their soybeans and corn. This shifted historical global trade patterns and sent a bearish ripple through the U.S. and global markets on which producers rely.

The American farmers – notably producers of the highly sought corn and soybeans that form the backbone of our global food and feed industries – faced enormous economic pressures. The Trump Administration responded to the clamor with compensatory payments of $28 billion in 2018-19, and two more tranches of $19 billion in April and $14 billion in September.

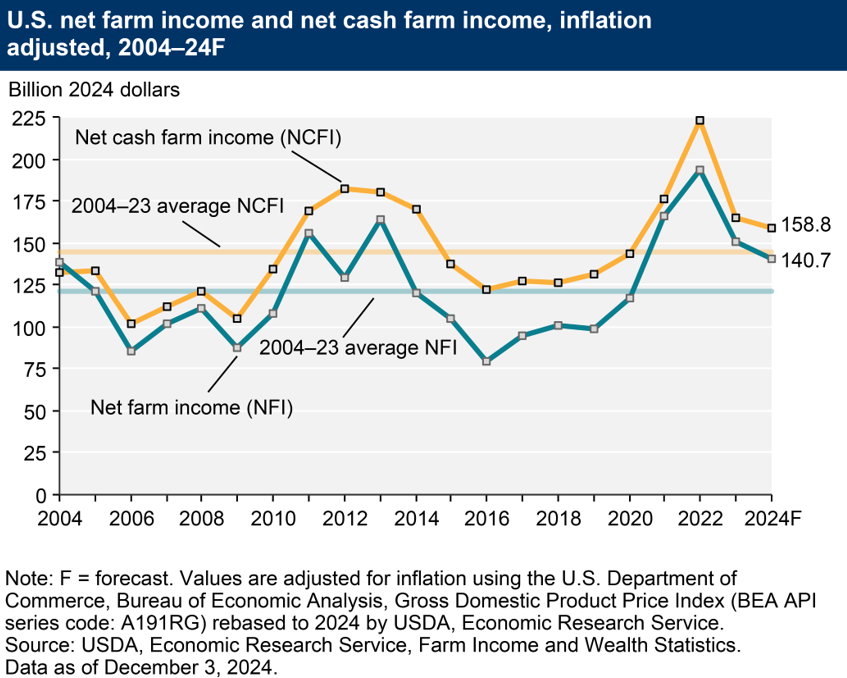

The proposed new tariffs come at a time when the farm economy is already facing tough going. As the Department of Agriculture noted in January 2025: “In inflation-adjusted 2024 dollars, net farm income is forecast to decrease by $9.5 billion (6.3 percent) from 2023 to 2024. Net cash farm income is forecast to decrease by $5.7 billion (3.5 percent) from 2023 to 2024.”

The poor economic conditions facing farmers as low commodity prices and continuing cost increases squeeze their profitability prompted Congress in December to add $31 billion in emergency funds in the last-minute extension of the farm bill. The prospect of a contentious trade war is pouring gas on the smoldering embers of economic concern.

Why are tariffs back on the national agenda?

Supporters of the new and higher tariffs argue the action is justified for several reasons.

First, the United States needs the income. Washington is a voracious master, demanding more and more money every year.

And in fact, we need more than we currently have.

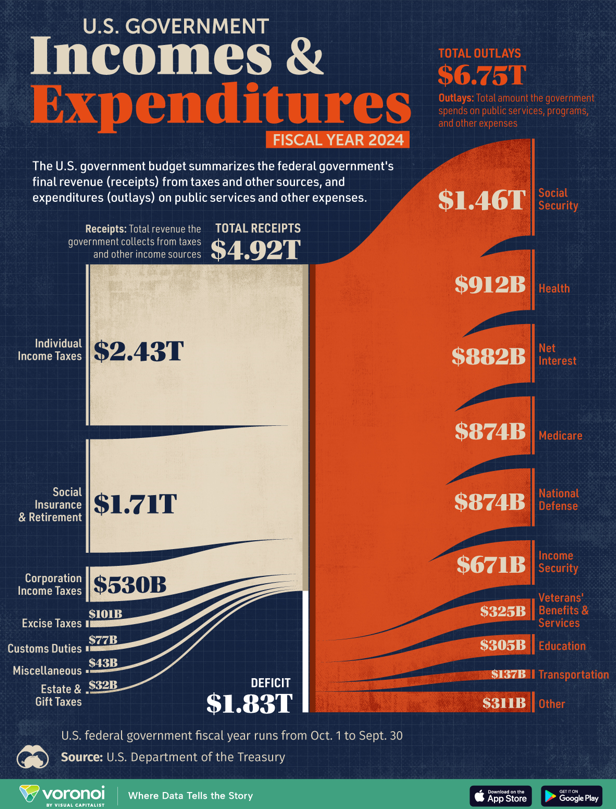

The federal deficit in 2024 is estimated at $1.83 trillion, surpassed in our national history only by the pandemic years of 2020 and 2021. This leaves our current debt to GDP ratio at 129%, to be outdone by Japan, Venezuela and Sudan.

With more middle school math, that means every American would owe $5,273.78 to make good on 2024’s shortfall. For a family of four: $21,095.10. And that’s just for the year’s deficit. The accumulated U.S. debt is much, much larger – clocking in at $93,500 per person.

What else can be accomplished with tariffs?

For anyone who has followed President Trump, it comes as no surprise that he has made greater fiscal discipline a priority for his administration.

To President Trump, tariffs also offer a powerful incentive to other countries to act more aggressively on matters within their national boundaries that have pernicious effects on the United States. As a businessman, President Trump seems to value the power of simple economics over media-focused diplomacy.

By creating significant economic costs to these nations, he seems to reason, the United States can incentivize foreign governments to be far more active. This includes dealings with such things as out-of-control cartels flooding the United States with drugs and danger for U.S. residents — and fomenting their own domestic unrest, violence, fear and desperation that drive rampant illegal immigration to the United States.

President Trump just used this tactic this week when negotiating with Colombia to accept deported migrants to avoid the U.S. imposing punitive tariffs and other penalties.

Who stands to be most affected by tariffs? This is not a simple subject. But if Canada and Mexico stem the tide, then the 25% tariff will be removed. And maybe the threat of more tariffs with Russia will help end the war.

The Bottom Line

Tariffs have returned as a major tool for the new Administration in domestic and global economics – and asserting American interests in international relations. History suggests those efforts won’t come without a cost to consumers, and once again the American agricultural community. Dirt-to-Dinner will continue to monitor developments as the new Administration moves ahead with its tariff agenda.