Rising beer prices: How will consumers react?

The Dirt

Tariffs indicate rising prices of imported beer for a variety of reasons, while beverage companies wait to see its effects to their bottom lines. But what does this mean for our wallets?

Global Food

Rising beer prices: How will consumers react?

The Dirt

Tariffs indicate rising prices of imported beer for a variety of reasons, while beverage companies wait to see its effects to their bottom lines. But what does this mean for our wallets?

Tariffs are creating an enormously complex and challenging market scenario for foreign companies, importers and domestic consumers alike – with an anticipated bottom line of higher costs.

To illustrate the complexity of today’s tariff scenario, we’re turning to one of our favorite beverages as an example of how a seemingly simple product can pose global pricing challenges. It’s important to note that until each country completes its negotiation with the Trump Administration, we can’t be sure of its effects on pricing and trade. But here’s where negotiations stand as of today.

U.S. Demand for Imported Beer

Pity the poor American beer drinker. At least, pity anyone who likes beer from countries outside the United States. Tariffs are an economically significant development for everyone from the barley grower in the American heartland to cookout enthusiasts at the backyard barbeque.

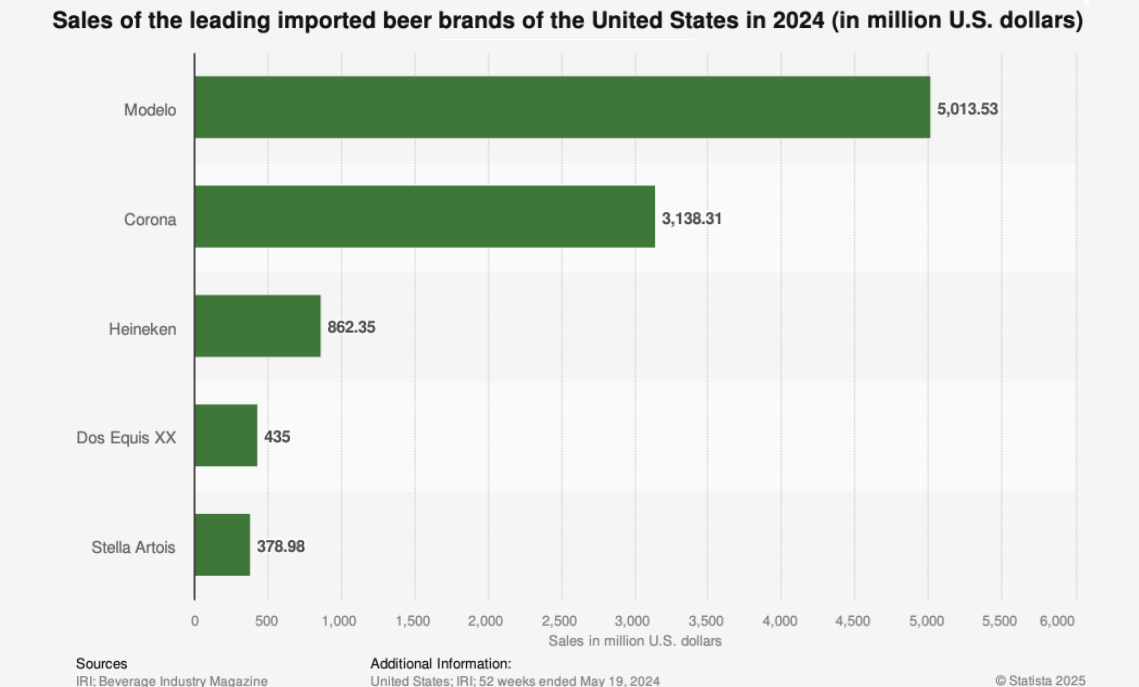

Beer imports have been a fast-growing segment of the beverage industry, with the U.S. market reaching as much as $11 billion in 2024. This was driven by robust U.S demand for popular brands from Mexico (Modelo, Dos Equis and Corona) and the European Union (Heineken, Stella Artois and Guinness). Canada also joins the list with robust sales of such beers as Labatt’s and Molson.

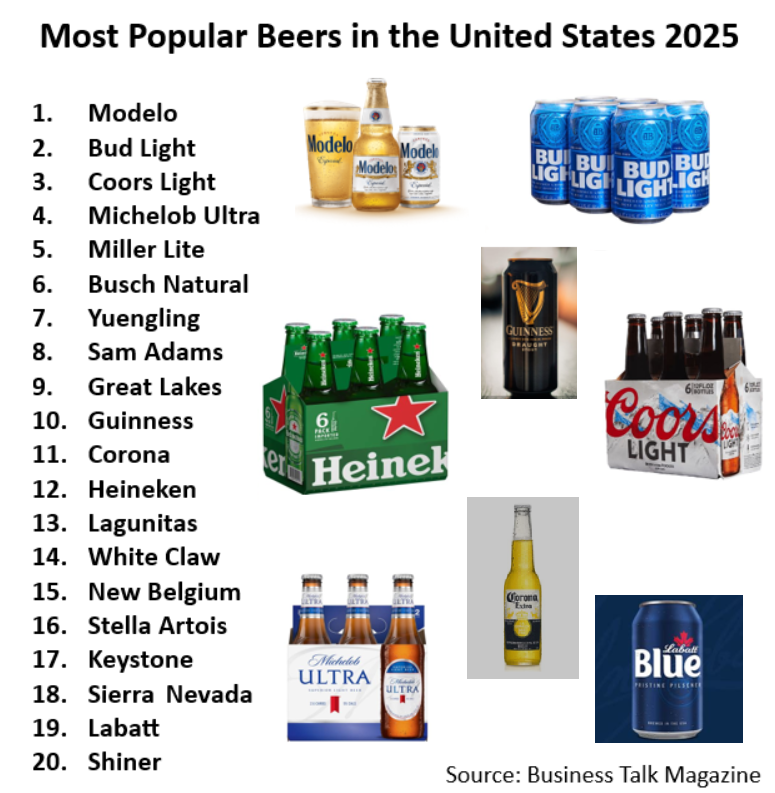

Since June 2023, Mexico’s Modelo Especial has surpassed Bud Light as the best-selling beer in the United States.

Corona Extra, Negra Modelo, Dos Equis and Corona Light all had a place in the top 20 list.

Modelo’s share of the imported beer market now exceeds 30 percent, with Corona at roughly 17 percent, Heineken at 15 percent and Guinness at roughly 12 percent. The roster of best-selling beers in the United States shows the dominance of Mexican beer brands:

Brewing Tariff Concerns

But anticipated growth for this segment is in flux.

The imported beer industry has been caught in the middle of global trade disputes. New tariffs are hitting Mexico, Canada, and the EU, and the impact depends on which way the beer is flowing.

Here are some of the ways countries are currently getting hit with beer tariffs:

United States Tariffs

-

50% tariff on aluminum cans (applies to all imported canned beer, including from Canada and Mexico)

-

Additional country-specific tariffs apply to beer itself

-

10% tariff on most alcoholic beverages from countries not covered by other executive actions

Mexico’s Tariffs

For U.S. imports:

-

Delayed response at first to U.S. tariffs

-

As of August 2025, 25% tariff on many Mexican goods entering the U.S.

-

Ongoing U.S.-Mexico trade talks, with a potential deal by November 2025

For EU imports:

-

EU-Mexico Global Agreement eliminates tariffs on food and drinks, including beer

-

25% U.S. tariff applies to Mexican goods going to the U.S., but not to beer sent to the EU

Canada’s Tariffs

For U.S. imports:

-

Canada imposed 25% retaliatory tariffs on U.S. beer, wine, and spirits in early 2025

-

Retaliation followed U.S. 25% tariffs on Canadian goods outside of USMCA coverage

For EU imports:

-

U.S.-EU trade deal (July 2025) set a 15% import tax on most EU goods, affecting Canadian beer exports to the EU

-

EU counter-tariffs on some U.S. goods, but alcoholic beverages excluded

Europe’s Tariffs

For U.S. imports:

-

EU imposed 15% tariffs on most U.S. goods in response to U.S. trade actions

-

Announced additional retaliatory tariffs in March 2025 on U.S. beer, bourbon, and other products

Production Costs & Tariffs

Recent tariff increases have muddied the picture for beer imports, however. The Trump Administration in April announced an overall tariff of 25 percent on beer imports, followed on the July 4 “Liberation Day” with an additional 10 percent tariff.

Perhaps of surprise to many consumers, tariffs on imports of aluminum play an important role in the potential price run-up for beer drinkers and other consumers.

Perhaps of surprise to many consumers, tariffs on imports of aluminum play an important role in the potential price run-up for beer drinkers and other consumers.

The beverage industry paid $1.7 billion for 8 million metric tons of aluminum between March 23, 2018 and August 31, 2022, according to a study by the Beer Institute, an industry trade group. Industry experts contend the aluminum tariffs add as much as 5 cents per can to the price of beer.

The barley sector also has a stake in the imposition of tariffs. While Canada grows its own barley, it is still the largest importer of U.S. barley, with Mexico being the third largest. (The EU relies largely on its own production of barley for brewing and animal feeds, importing roughly a half-billion dollars of barley per year).

Reciprocal tariffs imposed by countries that do import substantial amounts of U.S. barley could further compromise valuable export markets at a time of serious financial difficulties facing American farmers. In March, Canada imposed a 25 percent tariff on barley and other products, but has announced plans to scrap the counter-tariffs except for autos, steel and aluminum.

Revisiting the USMCA Agreement

Trump’s Administration seems intent on unwinding some of the trade tension by going back to the tariff schedules agreed in the 2020 United States-Mexico-Canada (USMCA) trade agreement. But the shifting tariff terms create uncertainty and worry across many economic sectors, including the U.S. farm community. The U.S. brewing industry shares these concerns.

Most larger brewers rely upon supply contracts, and the USMCA offers protection and hope for preservation of both Mexico and Canada barley markets. But smaller brewers face a tougher situation.

According to Bart Watson, president and CEO of the Brewers Association, as quoted by MSN:

“We have a fairly integrated North American barley and malt system. Because most U.S. barley is contracted by large brewers or for export to Mexico, a lot of craft brewers end up getting malt from Canada.

…Overnight, tariffs could add $60 million, give or take a little bit, to the cost structure of small brewers in the U.S.”

– Bart Watson, President & CEO of Brewers Association

This has led some brewers to start looking at other avenues for malt or to increase some European orders, which could also be impacted, based on threats from the administration.

The full effects of the complex tariff picture have yet to become fully apparent, as brewers, importers and retailers wrangle with how much of the added costs can be passed along to consumers already frustrated by rising food and beverage prices.

Higher transportation costs, energy prices and other costs of doing business add to the squeeze. Most industry figures agree the still-robust beer sector faces an uncertain consumer response to inevitably higher costs for imported beer.

Shift to Domestic Demand

The tariffs, along with rising health concerns and consumer budget pressures, have led to demand trends that worry beverage industry leaders.

Two of the most significant suppliers of imported beer – Canada, and even more so Mexico – enjoy a special exemption from the brunt of the tariff costs because of pre-existing trade agreements with the United States.

Two of the most significant suppliers of imported beer – Canada, and even more so Mexico – enjoy a special exemption from the brunt of the tariff costs because of pre-existing trade agreements with the United States.

As valuable as this exemption may be, it doesn’t completely free them from price pressures.

Analysts cited by birrup.com forecast that “the traditionally affordable imported beers may become luxury items, forcing consumers in price-sensitive segments to reconsider their preferences.

In response, there is anticipation of shelf space redistribution favoring either domestic beers or tariff-exempt contract-brewed alternatives, potentially altering the competitive landscape in the near term.”

Domestic beer producers would seem to have a potential advantage in the existing market picture. However, industry observers point to a tough market ahead with consumers shifting to non-alcoholic drinks and other ‘lighter’ alcohol choices. Even the popular craft beer industry has seen a drop in sales.

As summarized by toasttab.com, a restaurant point-of-sale service:

Beer prices are shaped by a combination of supply-side pressures—like rising ingredient, packaging, and transportation costs—and shifting consumer demand.

According to the NBWA Beer Purchasers’ Index (BPI), nearly every major beer category is experiencing a decline in demand, signaling a more cautious and competitive environment for bars and distributors.

Premium domestic beers are expected to fare comparatively well, especially as consumers compare prices for these brands against the most popular foreign brands. Light beers and ‘premium’ domestic beer brands (such as Michelob Ultra), however, potentially face increasingly price-sensitive consumers as well.

The picture for imported beer demand also is pessimistic. According to Toasttab.com:

Imported beers experienced the sharpest drop across all segments in 2025. The BPI for this category fell from 67 in March 2024 to 46 in March 2025, marking its first time in contraction territory since April 2020. That’s a 21-point decline—reflecting a significant pullback in distributor purchasing.

Despite falling demand, prices for imports like Heineken and Modelo are likely to remain elevated. International shipping costs, tariffs, and fluctuating currency rates continue to drive up the base cost, limiting how much retailers and bars can discount without eroding margins.

Prices in the Cooler

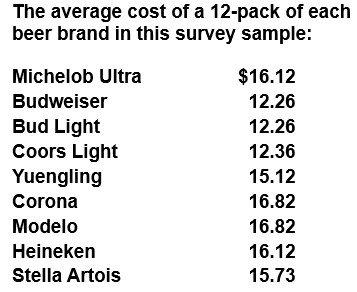

A completely unscientific survey of beer prices at a range of beverage retailers tells the story in stark dollars and cents. While the price for each beer may vary from area to area, the price disparity between domestic and imported beers seems clear.

In this sample, the disparity between domestic and imported averaged roughly $3 per 12-pack at $2.96.

In this sample, the disparity between domestic and imported averaged roughly $3 per 12-pack at $2.96.

The gap between imported beers and premium brand domestic beers was much smaller, but the disparity with the most popular standard domestic brands (Budweiser, e.g.) was closer to $4.50.

As birrup.com noted above, beer brewers and marketers are carefully watching the beer market to see how the shifting economics and prices affect consumer behaviors.

Will they pay the higher costs for premium brands – imported or domestic – or shift their buying habits toward lower price non-premium brands?

The Bottom Line

Beer prices are going up, due to a variety of reasons – tariffs, plus rising costs of production, transport and marketing. Premium beer brands, like the most popular imported beers, will command prices that risk making them a luxury item rather than a beverage staple for the average consumer.