Redrawing the Global Soybean Map

The Dirt

Soybeans have recently emerged onto the world stage – not just as a food source for people and animals, but as a powerhouse in international politics between China and the U.S., with Brazil and Argentina on the stage. Here is what you might want to know about how soybeans are being used as a political weapon.

Global Food

Redrawing the Global Soybean Map

The Dirt

Soybeans have recently emerged onto the world stage – not just as a food source for people and animals, but as a powerhouse in international politics between China and the U.S., with Brazil and Argentina on the stage. Here is what you might want to know about how soybeans are being used as a political weapon.

The other day, I performed my morning news check in the Wall Street Journal, New York Times, and on social media with X. Soybeans are now featured almost daily in support of our farmers coupled with tariffs and China.

Soybeans are not just another crop, they are a pillar of our food supply, fueling people, animals, and vehicles worldwide. They are a cornerstone of the entire food system.

Soybeans on Center Stage

Now, soybeans have become a weapon — a weapon China is using against the United States in retaliation for technology tariffs and stealing intellectual property. The American farmer is caught in the whirlpool of lower soybean prices, oversupply of unsold inventory, and tariff implications on their input costs.

To better understand the implications of the global soybean trade, we spoke to Gordon Denny, a prominent member of the United Soybean Board.

While speaking with Denny, he stated:

“Nowadays, politicians use food, agriculture and commodities as political levers without realizing the long-term implications of creating new trade relationships away from the U.S….killing trade balances and trade reliability, forcing huge investments by China in other countries, and ten other bad things.”

Last year, soybeans accounted for nearly $47 billion – almost a fifth – of all U.S. farm cash receipts. That’s more than wheat, cotton, vegetables or all other crops, and second only to corn as the financial lifeblood of farming.

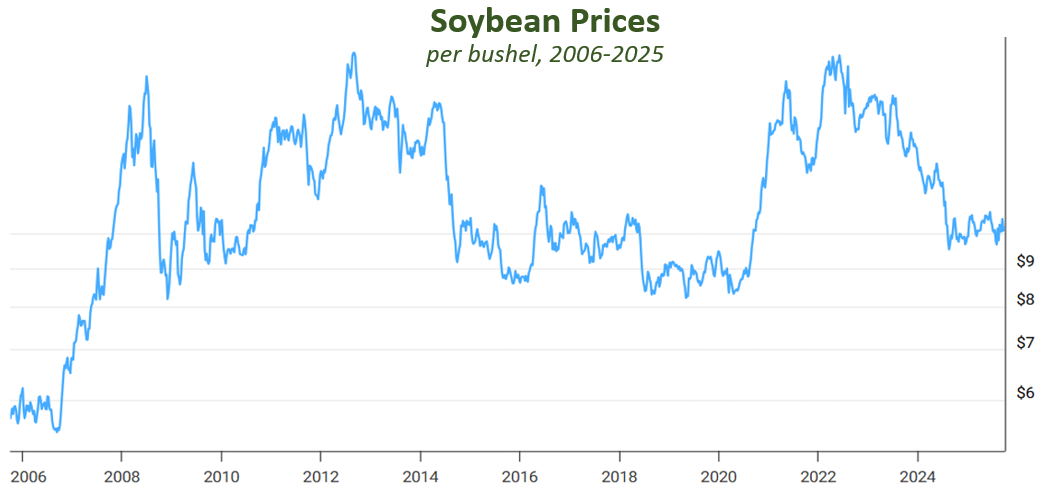

Despite the size of this market, growing soybeans is not for the faint of heart. Over the past 20 years, prices of soybeans fluctuated from $5.59 per bushel in 2006 to $17.04 in 2023.

Increased demand from China, combined with higher yields per acre resulting from technological advancements such as GMO seeds, precision agriculture, and better use of fertilizers, pesticides, and water has led to a significant increase in acreage planted.

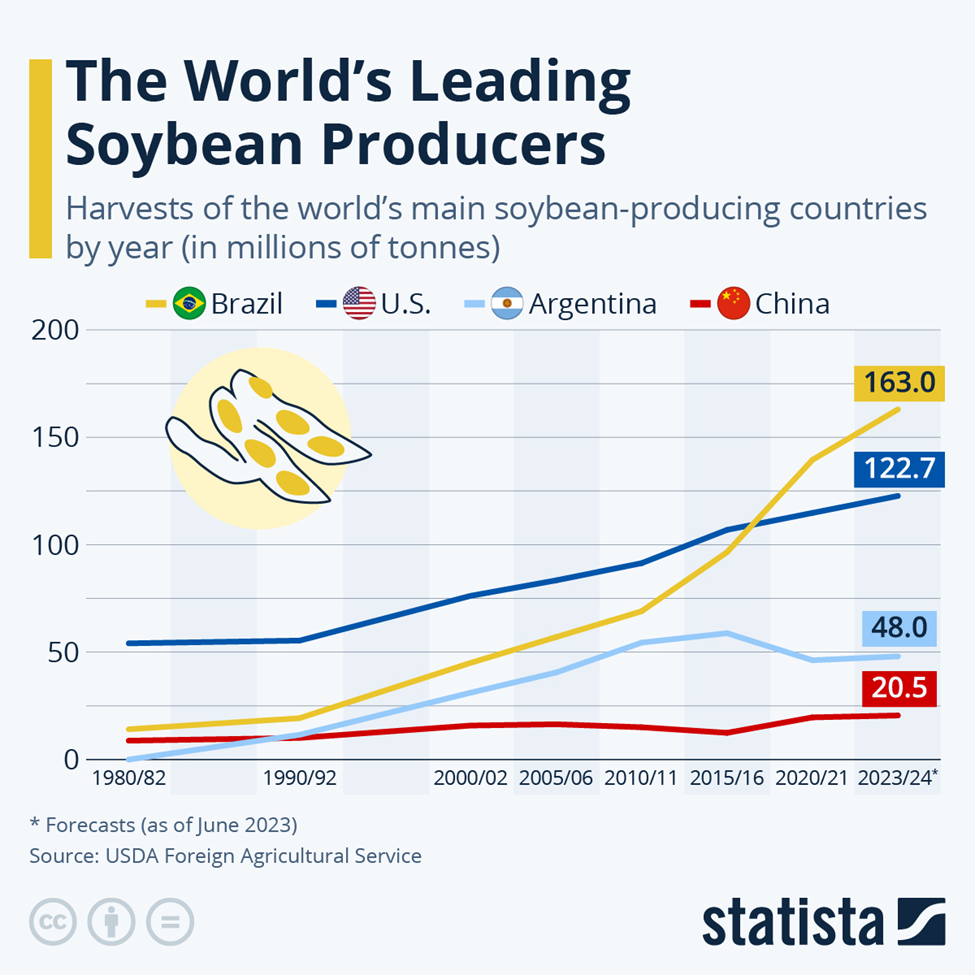

Global production has grown from 36 million metric tons in 1980 to 424 million metric tons in 2025. Brazil is the largest producer at 40% and the U.S. is next at 28%.

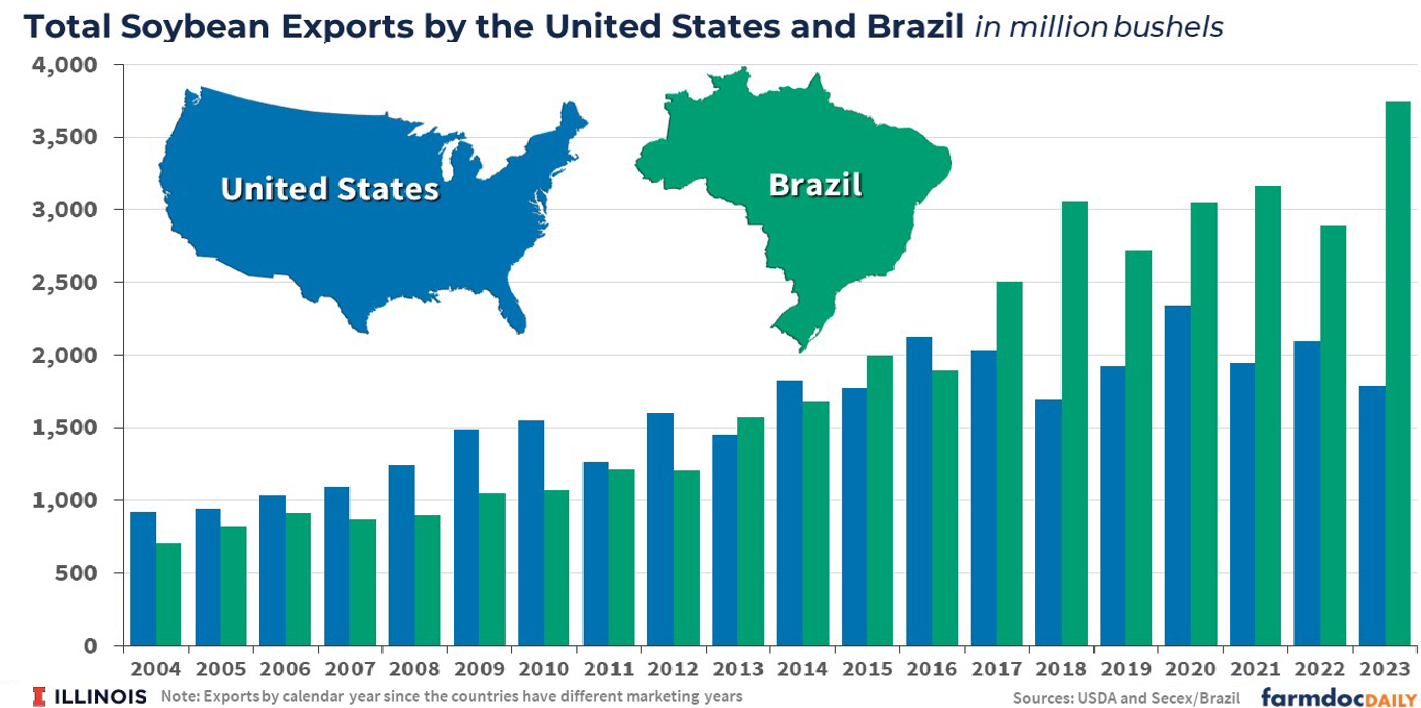

Ten years ago, the U.S. used to grow 70% of China’s imported soybeans. But it wasn’t just the trade war that shifted beans to Brazil.

In 2013, Brazil surpassed the U.S. as the largest soybean producer because their cost of production per acre is $54 lower. While their input costs such as fertilizers, fuel, machinery are higher, they can grow both corn and soybeans in the same season. Furthermore, they have more available acreage and at a significantly lower price: an acre in Brazil costs about $44, whereas the U.S. costs $182.

Who Eats the Most Soybeans?

Soybeans are a critical component of our diets. One cup of soybeans has about 28 grams of protein, 15g of healthy fats, and 17g of carbohydrates. But they are also full of fiber, calcium, magnesium, phosphorus, zinc and other minerals and vitamins.

Because they are so nutritious and digestible for animal growth and development, about 70% of the U.S. crop is crushed into feed for beef, pork, chickens, and turkeys. About 15% is for human consumption, like salad and cooking oils, and one of many ingredients in packaged foods. The rest of the oil is used for bio-diesel and other industrial products.

Surprisingly, the largest consumers of global soybeans are hogs in China. And that is what the conversation is all about.

China has over 427 million pigs versus the United States’ 76 million. All those hogs need to be fed and soybean meal is a high-quality protein for muscle growth. It also has the important digestible mineral phosphorus for growth and development.

China: The Big Dog in Global Soybean Trade

China is the undisputed top dog in global soybean trade – and much more akin to a Tibetan mastiff than a pug. China accounts for 61% of all soybean trade, with imports ranging from 88 to 100 million tons annually in recent years, according to Statista. That’s a huge increase from 10.4 million tons in 2000.

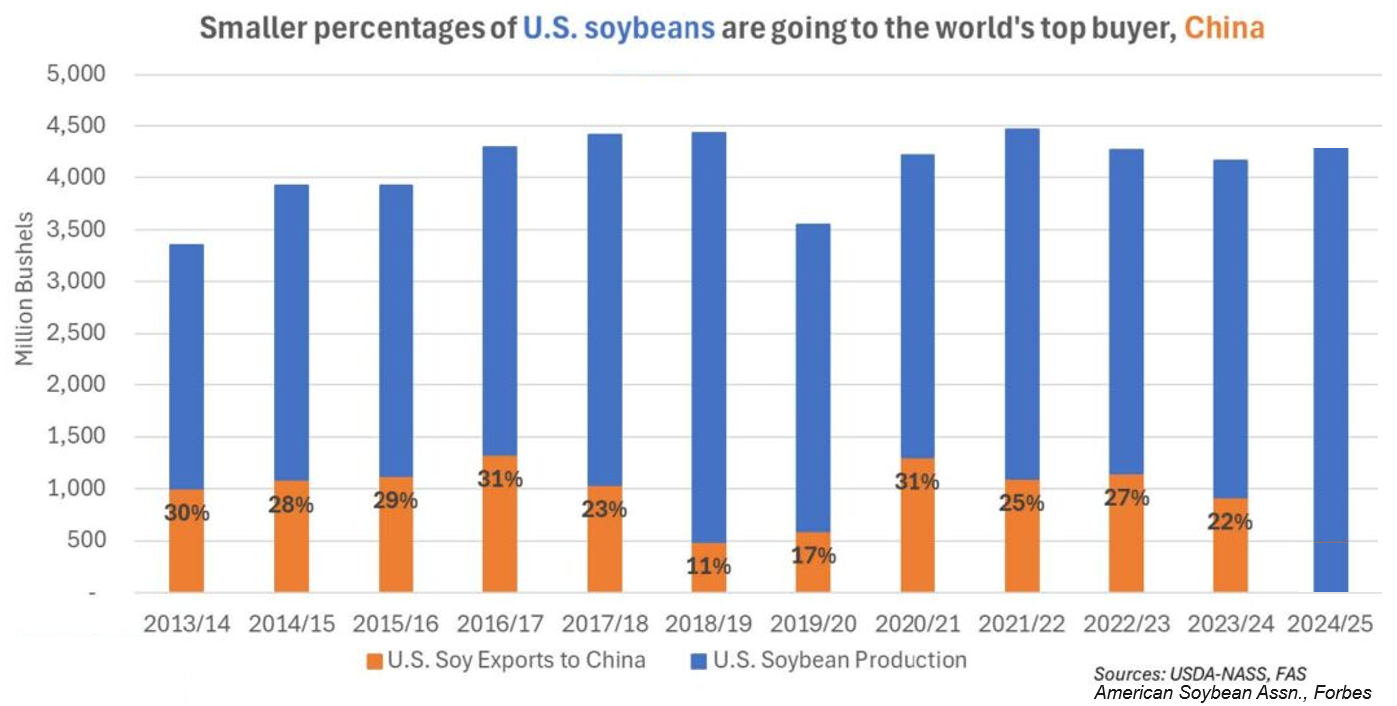

Prior to trade issues, U.S. growers had 61% of the China soybean market, now valued at $60 billion. Now it’s 22%, according to the American Soybean Association. China’s retaliatory tariffs on U.S. imports, value-added tax and most-favored nation duties place U.S growers at a serious disadvantage.

In fact, as of today, China has made no purchases of U.S. soybeans in the past two months and has no orders of U.S. beans in this harvest season.

While U.S. soybean growers have had to deal with the adverse effects of the on-going trade dispute with China, Brazilian growers have stepped into the fill that gap.

While U.S. soybean growers have had to deal with the adverse effects of the on-going trade dispute with China, Brazilian growers have stepped into the fill that gap.

The value of Brazilian soybean exports to China has gone from $15.8 billion in 2015 to just under $39 billion in 2023.

Argentina also has expanded soybean acreage and now produces almost 18 percent of the world’s total soybean crop, becoming a growing factor in global soybean trade.

A History of Trade and Tariffs

In 2018, President Trump announced that Chinese technology transfer, intellectual property theft, and joint venture requirements were detrimental to U.S. trade, and ultimately the consumer. He placed a 25% tariff on China exports to the U.S.

China hit the U.S. farmer hard with retaliatory tariffs on agriculture products, specifically soybeans. Chinese imports of U.S. soybeans dropped to 16mm tons from 33mm tons in 2017. The price dropped by $2.00 a bushel.

A truce was reached with an understanding that no more tariffs would be imposed, and China would purchase U.S. exports — including soybeans. However, China did not live up to its commitment. President Trump gave the U.S. farmers up to $28 billion in subsidies to make up the difference.

Fast forward to 2025: another trade war. A 125% tariff on Chinese imports and an 84% tariff on U.S. exports to China. As of today, China has refused to purchase even one soybean from the U.S. Instead, they are turning to Brazil and Argentina to feed their pork population.

Farmers Watching as History Repeats

All this has led to a negative soybean margin for the farmer. The U.S. Department of Agriculture (USDA) cost of production estimates in June pegged soybean production costs at $639 per acre in 2025, rising to a projected $650 next year. The USDA numbers reflect operating costs (e.g., seed, fertilizer, chemicals, fuel, repairs) and fixed costs (e.g., labor, taxes, insurance, machinery).

At an average yield of 53.3 bushels per acre, USDA data indicates that the overall cost of production for soybeans works out to $11.99 per bushel. For next year, according to the arithmetic, the total rises to $12.20.

The news is not good. Soybean futures contracts for this autumn currently are trading at about $9.98. USDA places average soybean prices for 2025/26 at $10.00 — a negative $2.20 per bushel of soybeans.

Understanding that a strong part of his support base are farmers, President Trump has announced another $10 billion aid package for farmers – the funds coming from current tariff revenue.

Agricultural Secretary Brooke Rollins plans to visit Vietnam, Japan, India, Peru, Brazil, and the United Kingdom in hopes to create new soybean export markets. Finally, there is also $285 million allocated to farmers as part of the Big Beautiful Bill.

“A trade disruption bailout does help farmers through a very tough spot that they had no part in starting. It does help the overall farm economy and helps politicians maintain votes.”

– Gordon Denny, United Soybean Board

Farmers Want Markets…Not Subsidies

But farmers want more than an aid package. As Denny stated, “farmers do not want government handouts, they want markets. Right now, the world has too many soybeans. There needs to be demand to pull the price of soybeans to farmer profitability.”

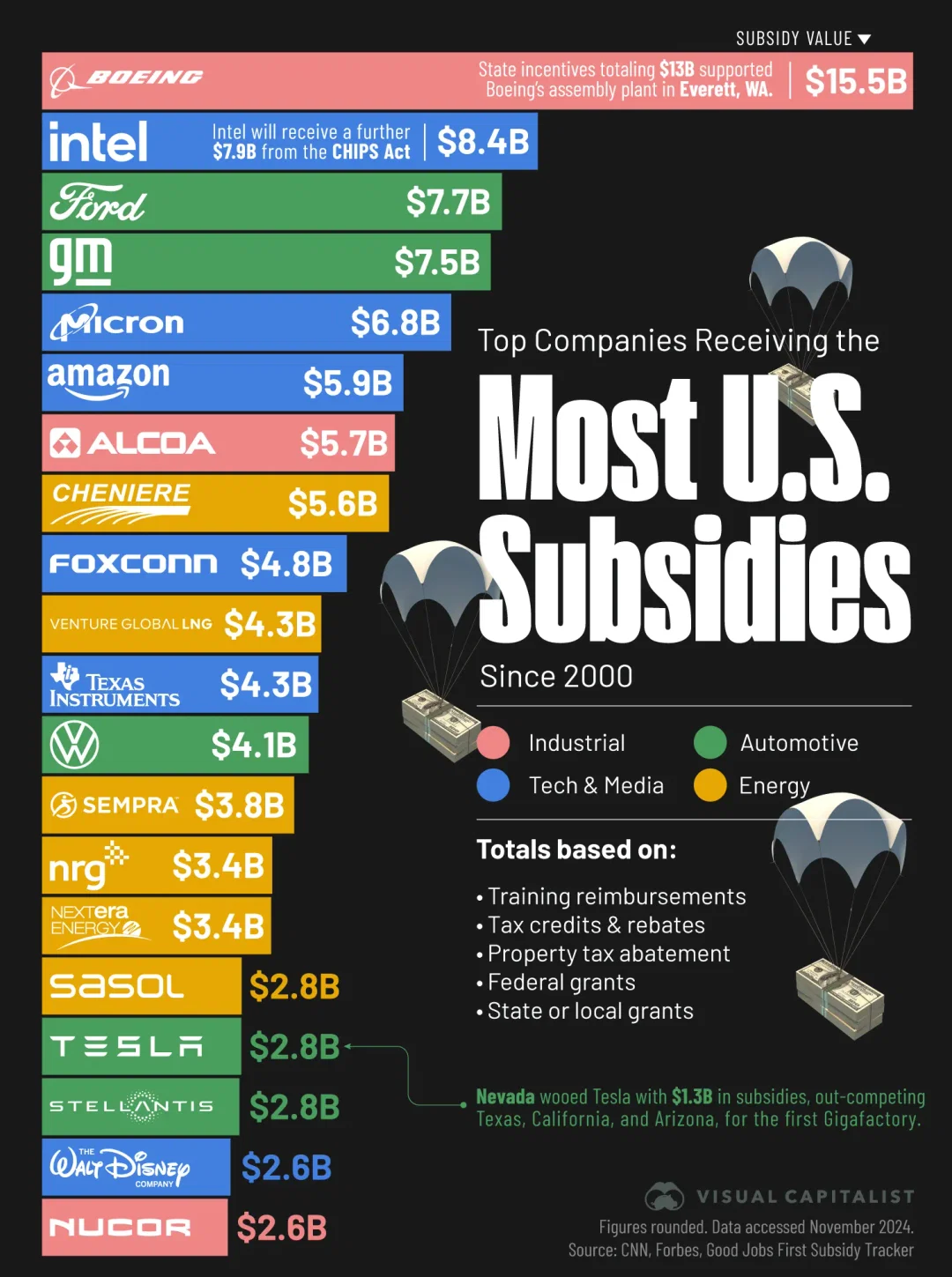

The ag industry isn’t the only one requiring government assistance…in fact, no industry is immune.

The ag industry isn’t the only one requiring government assistance…in fact, no industry is immune.

The U.S. government steps in with subsidies and bailouts when key industries face economic hardship, market instability, or strategic threats that could harm jobs, national security, or essential goods.

These interventions can include financial institution and airline bailouts after crises, or energy incentives to stabilize supply and protect the broader economy.

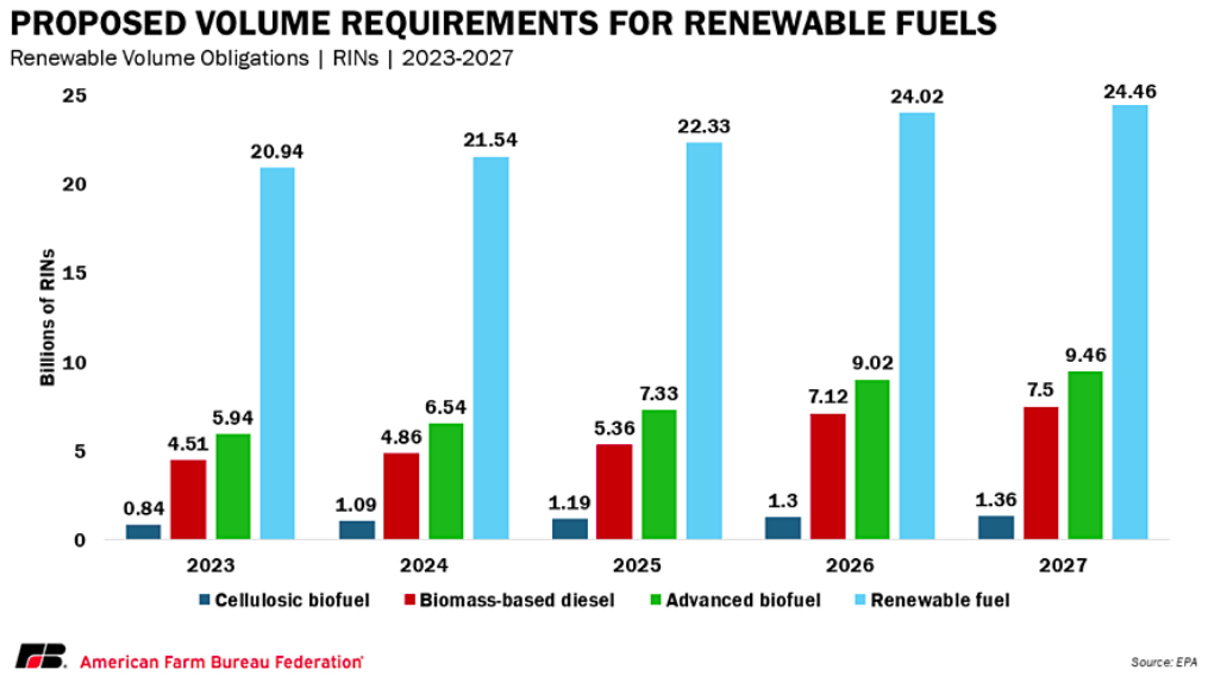

But how about the Renewable Fuel Standards? Will that help the ag industry? In July 2025, the Trump Administration announced a slight increase in overall fuels.

On behalf of U.S. soybean farmers, American Soybean Association expressed support for the rule, noting that it raises volume requirements for biomass-based diesel by 67%.

According to Denny, that is just another subsidy. “We need animal mouths. The more protein people eat, the more animals that are grown, and the more soybeans are crushed into feed. But right now, there are not enough animals to pull the U.S. farmer out of the doldrums.”

Again, the demand is not strong enough to completely solve the soybean oversupply and all renewable fuels require subsidies, tax credits, mandates, and tariff protection.

The Bottom Line

With the ongoing U.S.-China tariff war, China is hitting the U.S. where it hurts the most: the U.S. farmer. The future is uncertain, but now we know that soybean production and a strong financial future do not always go hand in hand.

Latest in other news...

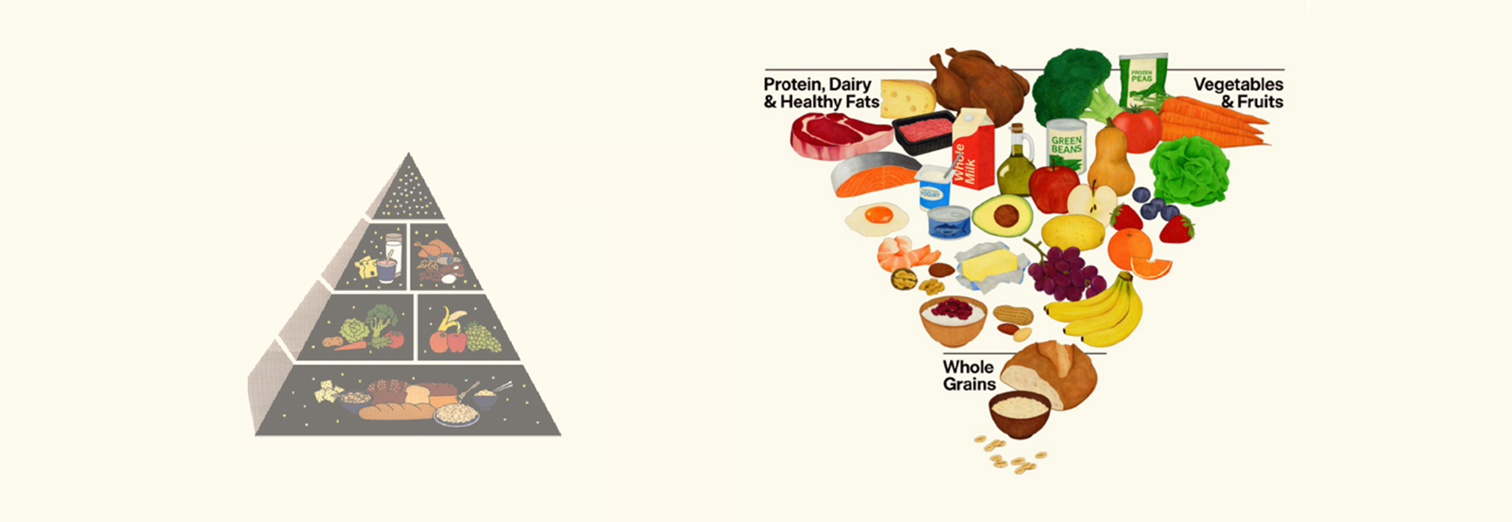

Transcript: The ‘Real Food’ Reset

This is a transcript for the podcast episode, "From Guidelines to Groceries: The Real Food Reset". The new USDA/HHS dietary guidelines marks a “historic reset” in U.S. nutrition policy with a straightforward message: eat real food. But how does this differ from current guidelines?