One Big Beautiful Bill for Dummies

The Dirt

So now that most of the political clamor has died down, what are the facts behind the Big Beautiful Bill for food producers and consumers? We burrowed through the nearly 900 pages of legislative language to find the key provisions – and found some interesting details behind the headlines and hoopla.

Global Food

One Big Beautiful Bill for Dummies

The Dirt

So now that most of the political clamor has died down, what are the facts behind the Big Beautiful Bill for food producers and consumers? We burrowed through the nearly 900 pages of legislative language to find the key provisions – and found some interesting details behind the headlines and hoopla.

The One Big Beautiful Bill Act that was signed into law July 4 is indeed big, but just how beautiful it may be depends largely on where you sit.

What stood out to us is that farmers and ranchers gained some valuable economic support from the bill.

In normal times, the headlines from this very big bill would still be reverberating throughout the media world. But they aren’t, by and large.

Part of the relative silence may be recognition that debate is over. The bill is law. Now we must deal with its effects, not argue about them any longer. Political reality is political reality.

Maybe a bigger reason is the relatively small place of farm programs and health and nutrition elements in a piece of legislation that cuts across virtually every segment of our economy.

Digging into the Dirt

The “OBBB Act” contains 10 separate titles and 296 separate sections, representing the collective effort of congressional committees to reconcile spending requirements with a stated desire to reduce deficit spending. Specific finance provisions regarding collective program spending and individual tax considerations make up almost half the total number of sections, many reflecting last-ditch efforts to secure the votes needed to pass the massive bill in compliance with President Trump’s July 4 deadline. Little wonder the introductory table of contents spans a full 13 pages.

Without getting lost in the tall, tall weeds of legislative language, let’s look at some of the top-line elements of the OBBB.

However, before, it is worth mentioning that supporting America’s farmers is critical for food security:

- There are almost 2 million farms in the United States out of 600 million globally. The average U.S. farm size is 466 acres. Of course, we hear of the demise of the family farm, but if you look at farmland in 1885, total acreage was 354 million, the size of Alaska, and today it is 876 million acres. About the size of Alaska, California, Texas, and Nebraska. 95% are family farms. Each year, on average, one U.S. farm feeds 170 people in the world.

- Trade is also a critical component of farmer income. The U.S. agriculture trade is in a deficit of $37b from a trade surplus of $35b as of 2014. We still export about 20% of our agricultural products. Most of that is big ag: corn, soybeans, canola, and cotton. For every $1.00 of ag exports, we have $2.00 of domestic economic activity.

To keep the farmer and rancher in business and providing enough food for both American’s and the world, the OBBB provides an economic safety net and tax relief.

What does the farming and ranching community get out of it?

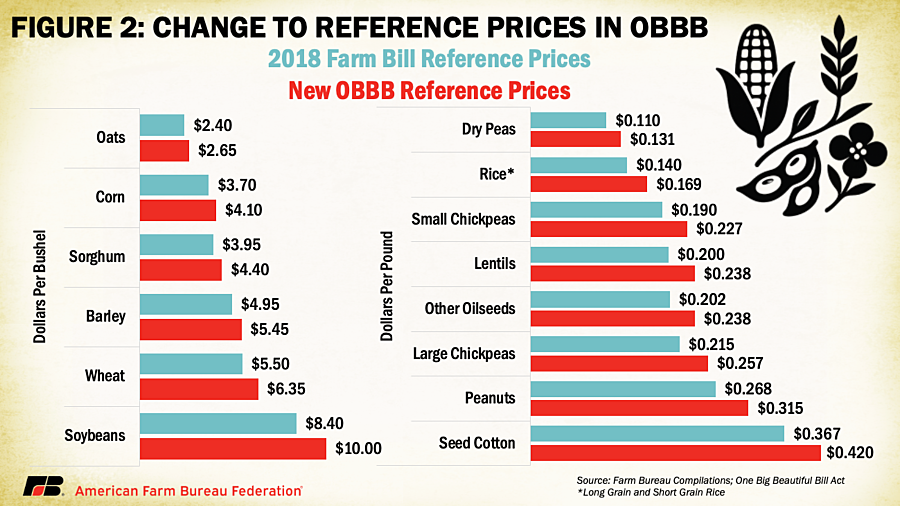

- An improved economic safety net. OBBB increases basic commodity support rates through higher “reference prices” and commodity loan rates. This means that the government pays the farm when crop prices fall below a certain level. Reference prices for each agricultural commodity are key to determining the federal dollars needed for farm payments under such critical economic protection programs as Agricultural Risk Coverage (ARC) and Price Loss Coverage (PLC).

- These increases were justified by their supporters as a necessary step to protect economically battered farmers – and the rural communities they support – from the harmful effects of rises in production costs during an extended period of weak commodity prices. It is also there to help the farming community to offset export losses due to tariffs.

- Expanded income protection access. OBBB also allows farmers to purchase additional coverage in the ARC program. This offers payments when a farmer’s actual revenue falls below a guaranteed level.

- Changes to farm-related taxes. By altering the capital gains tax regulations, farmers will now be able to sell farmland and make capital gains tax payments across four years – if farming operations are maintained for 10 years. This provision seeks to balance federal tax-income goals with a long-standing desire to avoid loss of active – and family-owned – farmland.

- Other business-focused tax changes. As business people, farmers and ranchers also stand to gain from the preservation and expansion of various tax regulations related to investments, such as estate tax exemptions and certain business income deductions. Certain depreciation deductions for various research and development activities also are continued.

- In a similar vein, OBBB proponents point to the possible economic gains available to farmers and others from permanent increases in the standard deduction to $15,750 and $2,200 in the child tax credit, both effective after 2025. Increases in the deduction for state and local taxes are expected to put money in pocketbooks.

- Preservation of clean fuel production credits. OBBB extends these credits through 2029 for fuel derived from crops.

- Miscellaneous program changes. Buried within the OBBB are various changes to funding for a wide range of agriculture-related federal activities.

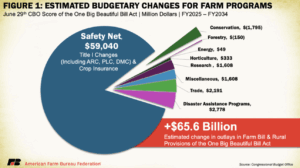

The price tag?

An estimated $65 billion in additional spending over the next decade.

How do we pay for all this?

To help pay for these economic protections, OBBB tightens a number of requirements and rules for health programs, as well as nutrition and health programs such as the Supplemental Nutrition Assistance Program (SNAP), designed to slow the pace of growth in federal program spending. And DOGE aims to eliminate waste and fraud.

The Congressional Budget Office (CBO) has estimated the changes in OBBB to health insurance could reduce federal spending by roughly $1 trillion – that’s $1,000,000,000,000 – over 10 years.

Over the next decade, however, OBBB would increase the federal deficit by $3.4 trillion and cause 10 million people to lose health insurance, CBO estimates.

The effects of OBBB on our national health care can’t be overstated. Major changes to Medicaid and Medicare tighten the criteria for program eligibility, with more effort by states to police abuses of the programs and higher co-pays. More program costs are shifted to the states. Provisions also affect eligibility under the Affordable Care Act. Roughly 130 million Americans rely on Medicare and Medicaid for health insurance.

For example:

- Expanded work requirements. To be eligible for Medicaid, recipients must work 80 hours per month.

- Funding mechanism changes. Financial devices used by states to cover these program expenses are limited, to avoid use of provider taxes, special payment provisions and other tools. The effect is to shift significant program costs to the states.

- States are required to step up the frequency of eligibility checks to assure benefits go only to those who meet the program standards.

- ‘Provisional eligibility’ is curtailed, meaning individuals must wait for completion of the eligibility and registration process before being covered.

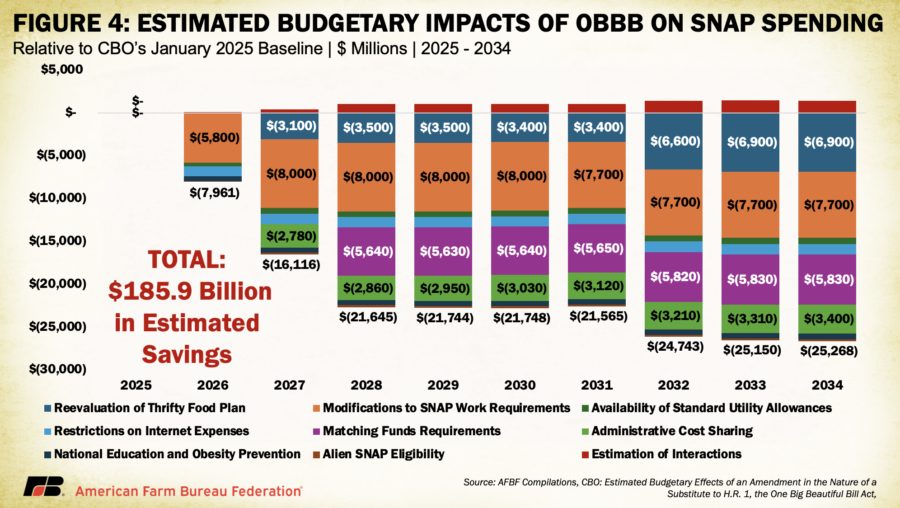

The other major area of targeted reductions in federal spending is SNAP. Like health-related federal programs, SNAP now faces and number of changes designed to reduce federal costs by stricter eligibility requirements and funding changes. Beginning in 2028, notably, states will pick up a greater share of the cost.

Key changes include:

- Reduced work waivers. OBBB expands the age brackets for those required to work and clamps down on the number of exemptions from work categories.

- Fewer deductions for the income thresholds defining eligibility.

- Decreased benefit updates in future SNAP payments.

- Higher state funding. States with higher program error rates would be required to pick up a greater share of SNAP costs. States with error rates over 6 percent would be required to pay 5-15 percent of costs. The Department of Agriculture estimates the average state error rate at 10.9 percent last year.

OBBB proponents say the tighter rules will help cut deferral SNAP spending by as much as $267 billion over the coming decade. CBO notes that even with the added federal funds for farmer economic assistance, overall federal budget savings from the comprehensive revisions to all farm programs (including SNAP) could be as high as $120 billion over the coming decade.

OBBB critics focus on a different kind of numbers.

The Center on Budget and Policy Priorities estimates that SNAP currently provides basic food assistance to more than 40 million people, including children, seniors and nonelderly adults with disabilities. The Urban Institute estimates changes to SNAP could mean 22.3 million families lose some or all SNAP benefits – 5.3 million losing at least $25 per month in benefits and an average loss fort families of $146 per month.

What about the consumer?

Supporters of OBBB focus on the numerous tax breaks in the bill as major benefits to a consumer society. While experts differ on the size and extent of the additional cash in consumer pockets, critics focus on the potential damage to consumer interests that might result if the economic growth promised from the OBBB doesn’t materialize, or falls short of the ambitious growth targets touted by the Administration.

Few economists or other food gurus seem to expect the Act to have any material effect on food prices, certainly not in the short term. If inflation resurges over time, food won’t be exempt from it, of course. But no one seems to think the OBBB will precipitate a dramatic surge in food costs on its own.

OBBB supporters also point out the positive effects for great swaths of middle America of shoring up the food producers economic protections and incentives for continued investment in food and agriculture. Maintaining a healthy and vibrant farm sector will help rural and urban consumers alike, they point out. Critics, in turn, caution that rising health care and food costs for the economically disadvantaged displaced by OBBB’s regulatory changes are anything but good news for those consumers.

What happens now?

One more detail from the OBBB stands to be of great importance to the farming community, rural America and food consumers everywhere. While OBBB helps shore up the economic safety net for farmers and ranchers, it didn’t provide the clear goals and objectives for our complex food system. OBBB addressed budgetary issues, not the basic policy parameters that will determine just how efficient and effective our modern food system remains in the face of expanding public expectations for a reliable, safe, wholesome and affordable food supply.

Our food policies are the stuff of the Farm Bill – the comprehensive package of policies and programs that guide and govern our modern food and agricultural system. OBBB provided a patch. But we’re still more than two years overdue for farm legislation, with a lengthy agenda of subjects to address – conservation programs, biofuels, environmental protection, trade, market regulation oversight, and much, much more.

Supporters of OBBB point to the gains made through the Act for farmers, rural communities and taxpaying consumers and speak optimistically of the future of a “skinny farm bill” that can at long last be enacted. Others more soberly comment that if what lies ahead is ‘skinny,’ no wonder we tend to overlook the epidemic of obesity that surrounds us.

The Bottom Line

The One Big Beautiful Bill represents another case study in our modern political process – trade-offs and compromises that create gains for some and potential loss for others. Our farmers received valuable and expensive improvements in their economic safety net. But others may face a tougher, more complicated road to the nutritional and health programs. Consumers, meanwhile, can take heart in OBBB’s contribution to maintaining the food production system we all rely upon.

One Big Beautiful Bill for Dummies

So now that most of the political clamor has died down, what are the facts behind the Big Beautiful Bill for food producers and consumers? We burrowed through the nearly 900 pages of legislative language to find the key provisions – and found some interesting details behind the headlines and hoopla.

Latest in other news...

Why Diet Quality Matters

Weight loss has never been easier with GLP-1s. However, recent research is reshaping the narrative: diet quality—not just pounds lost—drives long-term health. The foods we eat affect our mood, sleep, metabolism, digestion, and other key components that contribute to living long, healthy lives.