How Will Tariffs Affect Overseas Trade?

The Dirt

With President Trump's proposed tariffs looming on the horizon, we’re exploring its potential impact to the intricate web of overseas global trade, as well as our farmers and consumers.

Global Food

How Will Tariffs Affect Overseas Trade?

The Dirt

With President Trump's proposed tariffs looming on the horizon, we’re exploring its potential impact to the intricate web of overseas global trade, as well as our farmers and consumers.

Click Play to listen to our generated podcast. Click on links for transcript and our full podcast library.

As we dive into the complex world of ocean freight’s role in U.S. food imports and exports, it’s clear that the agricultural trade and transport landscape is facing some pretty choppy waters ahead.

The Current State of U.S. Agricultural Trade

Before we delve into the potential impacts of new tariffs on ocean transport, let’s take a snapshot of where U.S. agricultural trade stands today.

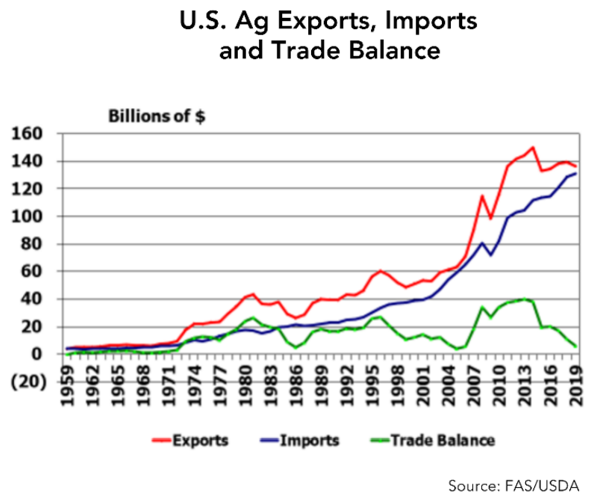

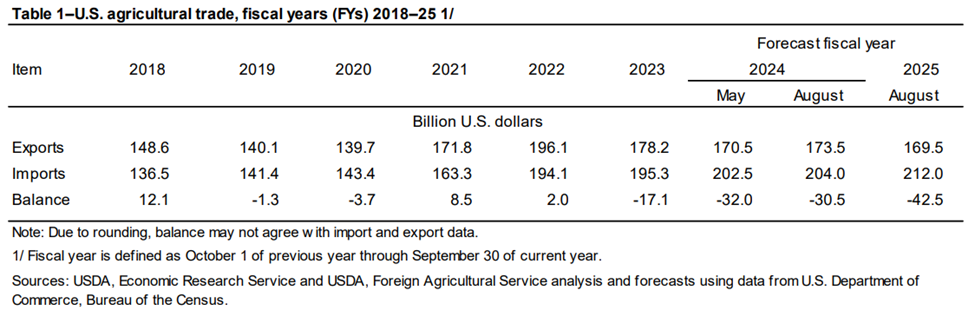

According to the latest data from the U.S. Department of Agriculture’s Economic Research Service (USDA ERS), U.S. agricultural exports for fiscal year 2025 are forecasted at a whopping $170 billion.

According to the latest data from the U.S. Department of Agriculture’s Economic Research Service (USDA ERS), U.S. agricultural exports for fiscal year 2025 are forecasted at a whopping $170 billion.

That’s a lot of soybeans, corn, and beef making their way to dinner tables around the world.

On the flip side, we’re also bringing in quite a feast from abroad. U.S. agricultural imports for the same period are projected to reach $212 billion.

From avocados to wine, our taste for international flavors continues to grow, leading to the largest trade deficit seen in over 65 years.

As an FYI, Garland’s recent post, Tariffs: Economic Boost or Negotiating Tool? does a great job exploring tariffs and their economic and political implications — we highly recommend the read.

The Ocean Freight Connection

Now, you might be wondering, how do all these agricultural products travel around the globe? The answer is primarily by sea. Ocean freight plays a crucial role in the movement of agricultural goods, both in and out of the United States.

Exports

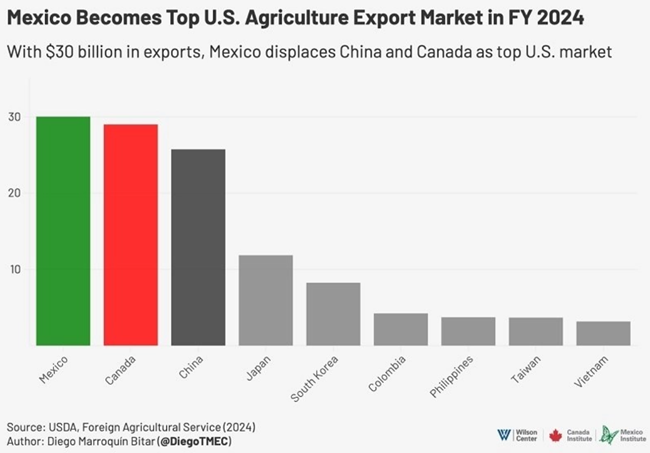

If you’re surprised by this, you have good reason: while container shipments only account for a quarter of U.S. agricultural exports by volume, they represent over half of the value of our total exports. That’s a lot of high-value goods sailing the seven seas. The destinations receiving the bulk of these goods are China, Canada, and Mexico.

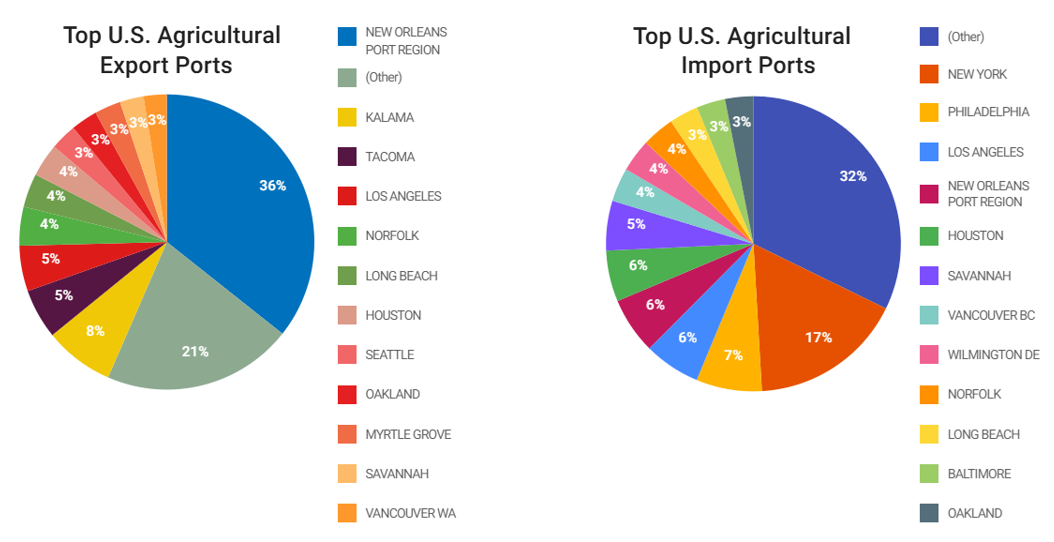

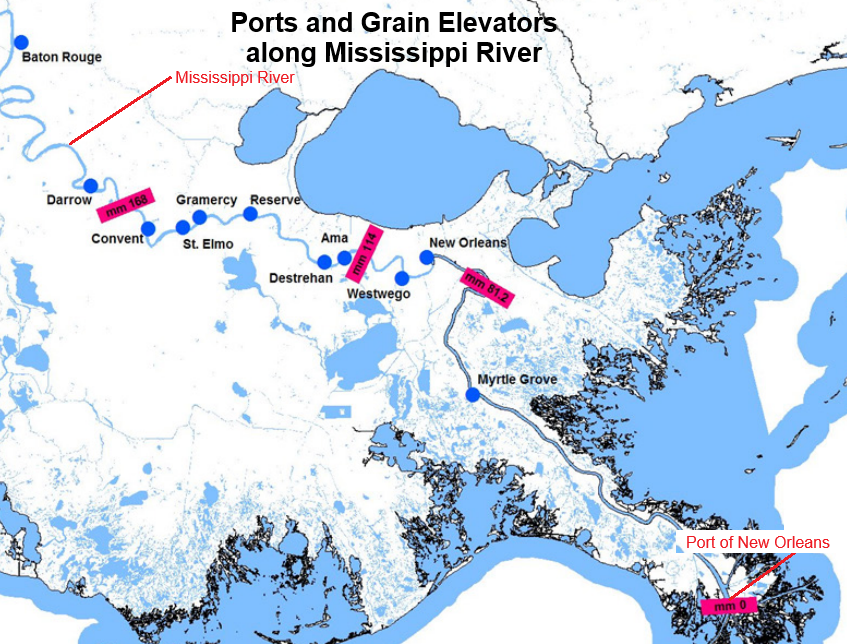

The busiest port in the U.S., the New Orleans Port Region, moves almost 40% of all U.S. waterborne ag exports alone.

Most of these exports were bulk grains and products, like corn, soybeans, animal feed, and rice. Other significant exports from this port include soybean and corn oils and frozen poultry.

But Gulf ports like New Orleans don’t just export ag products.

But Gulf ports like New Orleans don’t just export ag products.

In fact, the value of ag exports is a small portion of the total value of all goods. Because of the relative proximity of products to Mississippi River, these Gulf ports constantly crank out enormous amounts of oil and gas, chemicals, and ores, providing a cost-efficient transport corridor. Houston and New Orleans alone account for about 65% of total U.S. oil and petroleum exports.

Imports

The European Union and Mexico are the second and third largest countries in terms of agricultural imports into the U.S. Products received from these partners are mostly comprised of tropical fruits, sugar, soybeans, and packaged grocery and beverage items.

New York and Philadelphia rank highest on the receiving end for 2023, accounting for 17% and 7% of imported goods, respectively.

Trump’s Tariff Proposal: A New Trade Storm Brewing?

Now, here’s where things get interesting.

President Trump plans to impose 25% tariffs on Mexico and Canada set to take effect in March 2025, postponed from February 1. This ongoing negotiation has the attention of food producers, as Mexico has become one of our largest trading partners and increasingly important export markets for U.S. farmers in recent years, with most goods traveling overseas.

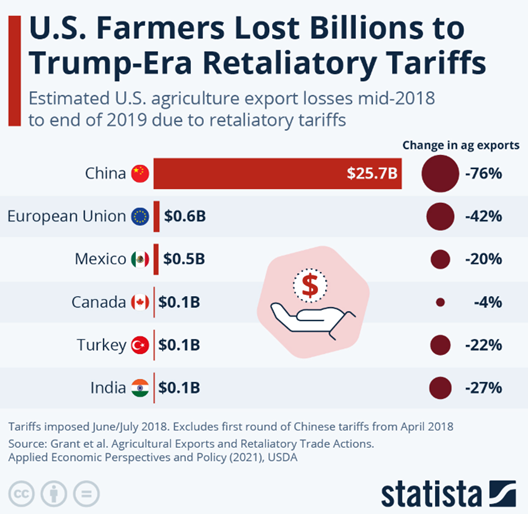

Trump has also directed federal agencies to review trade pacts with China. This has many farmers recalling Trump’s first term in office. As a result of retaliatory tariffs from the onset in summer 2018 through the end of 2019, the USDA ERS reported that U.S. agricultural export losses exceeded $27 billion, with soy and pork producers hit particularly hard.

Trump has also directed federal agencies to review trade pacts with China. This has many farmers recalling Trump’s first term in office. As a result of retaliatory tariffs from the onset in summer 2018 through the end of 2019, the USDA ERS reported that U.S. agricultural export losses exceeded $27 billion, with soy and pork producers hit particularly hard.

China’s swift retaliation accounted for about 95% of the value lost, but our losses were significantly mitigated by an outstanding trade agreement with China to purchase U.S. soybeans, leaving many questioning how losses might affect us next time around.

Potential Outcomes on U.S. Ag Trade

In what ways could these tariffs affect U.S. farmers and exporters? A number of things could happen that disrupt our current flow of goods, both incoming and outgoing. And these factors affect one another, leading to thorny diplomatic situations with various scenarios to navigate.

Let’s break down these potential situations:

- Reduced Competitiveness: New tariffs could make U.S. exports less competitive on the global stage. This could open the door for competitors like Brazil to gain more market share, particularly in soybean exports.

- Retaliation Risks: If history is any guide, we might see retaliatory tariffs from affected countries. During the 2018-2020 U.S.-China trade war, U.S. soybean exports to China plummeted from $14 billion in 2016 to just $3 billion in 2018 – a staggering 78% decrease.

- Market Disruptions: The tariffs could disrupt established trade flows. For instance, Mexico is a major supplier of fresh fruits and vegetables to the U.S.

- Price Fluctuations: Tariffs could lead to price increases for a wide variety of food and beverage products, affecting both consumers and the food industry.

- Potential Export Losses: During the previous trade war, U.S. agricultural producers faced approximately $27 billion in lost exports between 2018 and 2019, with soy and pork producers hit particularly hard.

For more information on these scenarios, refer to our article, Tariffs: Economic Boost or Negotiating Tool?

Freight Impacts from Trade Tensions

Now, let’s consider how these potential tariffs might affect ocean freight costs. It’s a bit like predicting the weather – there are many factors at play, but we can make some educated guesses based on past experiences and current trends.

- Demand Fluctuations: If tariffs lead to reduced trade volumes, we might see a decrease in demand for shipping services. This could potentially lead to lower freight rates in the short term.

- Route Changes: Tariffs might cause shifts in trade routes as countries seek new markets or suppliers. This could impact shipping patterns and potentially affect freight rates on certain routes.

- Uncertainty Premium: The uncertainty created by trade tensions and changing policies could lead to volatility in freight rates as shipping companies try to navigate the new landscape.

- Capacity Adjustments: If trade volumes decrease significantly, shipping companies might reduce capacity by idling ships or slowing vessel speeds. This could eventually lead to higher freight rates as supply adjusts to demand.

The Bigger Picture: Beyond Tariffs

While tariffs are grabbing headlines, it’s important to remember that they’re just one piece of the complex puzzle that is international trade.

Several factors beyond tariffs can significantly influence U.S. agricultural exports and ocean freight costs.

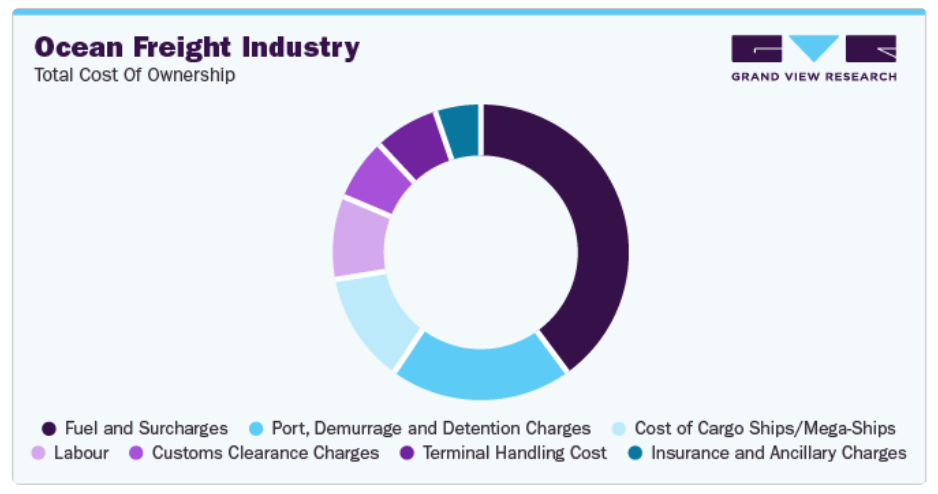

Of course, there are the immediate costs of maintaining these ships and its transport across the world. Operators of these vessels must contend with the ever-changing costs of fuel, accounting for about 40% of total costs. Insurance and labor also factor in, but the fees associated with port and custom fees also command a significant chunk of its operations.

External factors out of the operator’s control make the industry far murkier. The overall health of the global economy plays a crucial role in determining the demand for U.S. agricultural products. And this is largely driven by the supply and demand cycle of the industry — a constant balancing act between volume of goods and ocean freight capacity. Add in the effects of unpredictable weather patterns and crop yields, and you’ve got the perfect conditions for volatile capacity constraints.

Additionally, fluctuations in the value of the U.S. dollar can impact the competitiveness of U.S. exports in international markets. And the ever-changing landscape of environmental standards for shipping can also have implications for freight costs in the coming years, as the industry adapts to more sustainable practices and technological innovations.

But timing is everything when it comes to the ocean freight market. Because of these variables, operators will often book freight far in advance as an economic hedge for rising costs. This means the shorter-term factors cited above are a bit secondary to the market’s perception of overall economic drivers.

Looking Ahead: Navigating Choppy Waters

As we look to the future, it’s clear that U.S. farmers and exporters may need to brace for some chop ahead. The potential implementation of new tariffs could reshape the landscape of agricultural trade, impacting everything from commodity prices to shipping routes.

However, it’s not all doom and gloom. The resilience and adaptability of the U.S. agricultural sector have been tested before, and farmers have shown remarkable ability to weather economic storms. Moreover, the increasing global demand for food provides a strong foundation for U.S. agricultural exports in the long term.

And it’s important to note that tariffs can be used as a negotiation tool, as well as instigating action from our trading partners. Should Canada and Mexico curtail illegal immigrants coming across the U.S. border, tariffs would be expected to dissipate. We would also expect a similar change to tariffs with China, should fentanyl and other dangerous substances cease to enter the U.S.

As consumers, we might see some changes in the prices and availability of certain products, particularly those that rely heavily on imports or exports affected by the tariffs. However, the diverse and robust nature of the U.S. food system should help mitigate major disruptions.

The Bottom Line

While President Trump's proposed tariffs could certainly make waves in ag trade and ocean freight, the full impact remains to be seen. Whether you're a farmer in the heartland, a logistics manager at a port, or a consumer at the grocery store, staying informed about these developments will be crucial in the time to come.

One Big Beautiful Bill for Dummies

So now that most of the political clamor has died down, what are the facts behind the Big Beautiful Bill for food producers and consumers? We burrowed through the nearly 900 pages of legislative language to find the key provisions – and found some interesting details behind the headlines and hoopla.

Latest in other news...

Why Diet Quality Matters

Weight loss has never been easier with GLP-1s. However, recent research is reshaping the narrative: diet quality—not just pounds lost—drives long-term health. The foods we eat affect our mood, sleep, metabolism, digestion, and other key components that contribute to living long, healthy lives.