Food’s Huge Stake in Global Tariff Battle

The Dirt

The threat of a tariff war continues to puzzle almost everyone – none more so than the entire U.S. agricultural sector. While the final tariff numbers remain very much in flux across the entire global trading system, one thing remains certain: the stakes in this trade showdown are enormous for farmers, ranchers, taxpayers...and dinner tables across the country.

Global Food

Food’s Huge Stake in Global Tariff Battle

The Dirt

The threat of a tariff war continues to puzzle almost everyone – none more so than the entire U.S. agricultural sector. While the final tariff numbers remain very much in flux across the entire global trading system, one thing remains certain: the stakes in this trade showdown are enormous for farmers, ranchers, taxpayers...and dinner tables across the country.

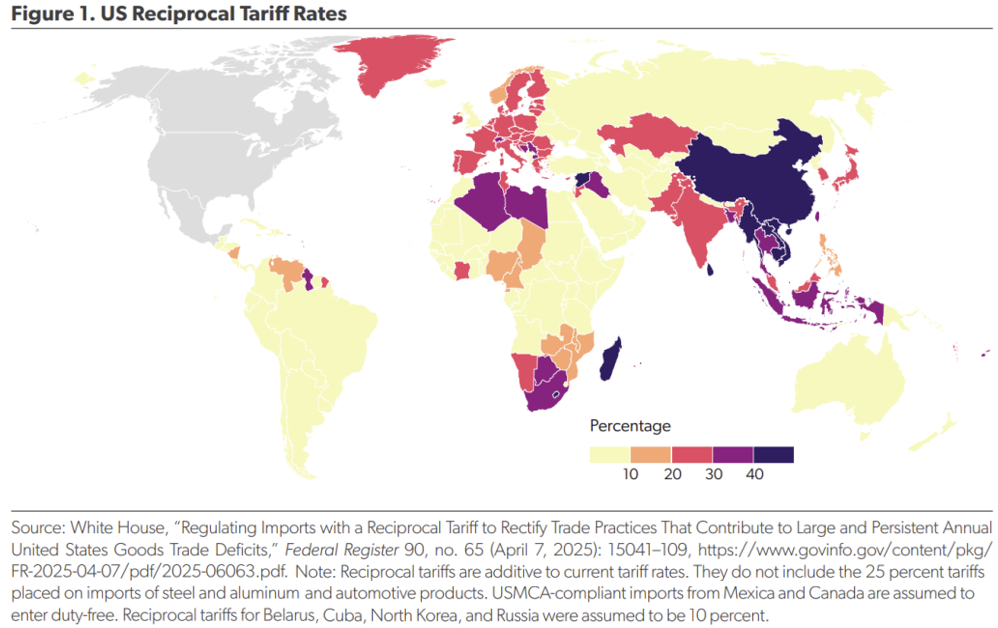

President Trump called April 2, 2025, “Liberation Day,” citing a national emergency from the continuing trade imbalance between the United States and 185 countries, out of 195 in the world. The President announced an aggressive program of tariff increases and especially aggressive reciprocal tariffs against those countries deemed to have unacceptably inequitable trade relationships with the United States.

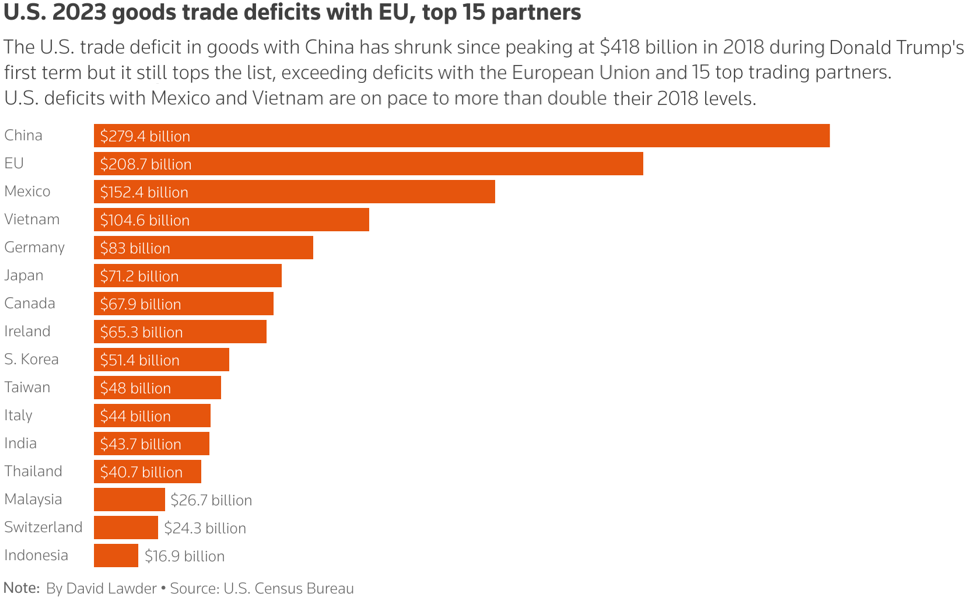

The reasons behind Liberation Day seem obvious enough. The United States had a trade deficit in goods – meaning more in the value of imports than in exports – of an estimated $1.2 trillion in 2024. The Trump Administration’s objective is to bring jobs back to the U.S. and rebalance those tariffs that are higher in other countries than we have here. The largest deficits were with China ($295 billion), Mexico ($172 billion), and Vietnam ($123 billion). (Estimates of the deficits vary slightly among different sources but generally align with these numbers.)

The other compelling reason was the tariff imbalance. For instance, the EU remains a major customer for U.S. agricultural exports but responded to the initial U.S. tariff action on steel and aluminum by announcing plans in March for their own aggressive tariffs on imports, affecting an estimated $20 billion in U.S. products, on top of $9 billion in tariffs on aluminum and steel from the United States. Targets include soybeans, beef, sugar, dairy and pork – including a tariff of 25 percent on corn, and as yet undetermined level for soybeans.

Trying to follow the evolving tariff proposals is like watching a jigsaw puzzle being assembled in real time—with new pieces added every day, and no one quite sure what the final picture will be.

Current trade situation

Over the past year, the EU has purchased roughly 3.4 million tons of U.S. corn, mainly for use in their livestock feeding. Total 2024 sales of U.S. corn to the EU were valued at $359 million. The EU soy market is even larger, with imports of U.S. soybeans, meal and oil worth roughly $3 billion and accounting for over 10 percent of all U.S. soy exports.

U.S. agricultural exports to the EU have long faced significant roadblocks as EU legislators sought to protect their rural and farming sector. Phytosanitary standards and other food-safety claims have been used to prohibit or prescribe the food products allowed to be imported, on top of protective tariff levels from 6 to more than 30 percent.

The red numbers are nothing new. In the month of February 2025, we had a deficit of $122.7 billion — a stark contrast to the last time we had a trade surplus of $15.9 billion back in 1975. Coupled with rising federal deficits, the trade imbalance has been a thorny fiscal issue policymakers have been reluctant to tackle, due largely to the enormous implications for the national economy and the global international economic system. Presidential candidate Trump promised to take action, and President-elect Trump lived up to his word.

In the weeks since Liberation Day, the promised tariffs have roiled the international trade system and entire economic order. Critics quickly questioned the value of imposing such tariffs on two of the country’s most important trading partners. The Administration and tariff supporters promptly noted that the highest agricultural trade deficits are with Mexico ($18.8 billion) and Canada ($12.5 billion).

In 2024, the United States is now on pace to reach a $39 billion agricultural trade deficit, the worst in our history.

This 2024 deficit is larger than any trade surplus year besides 2011.

– Andrew Rechenberg, Coalition for a Prosperous America, January 16, 2025

As might well be expected with such a dramatic step, the tariff announcement quickly produced more questions than clear answers. When would they actually begin? What products might be exempt? What are the chances for bilateral trade agreements to avoid or moderate the actual tariffs? The roster of questions continues to grow, with increasing uncertainty apparent in markets worldwide.

How will tariffs affect farmers & producers?

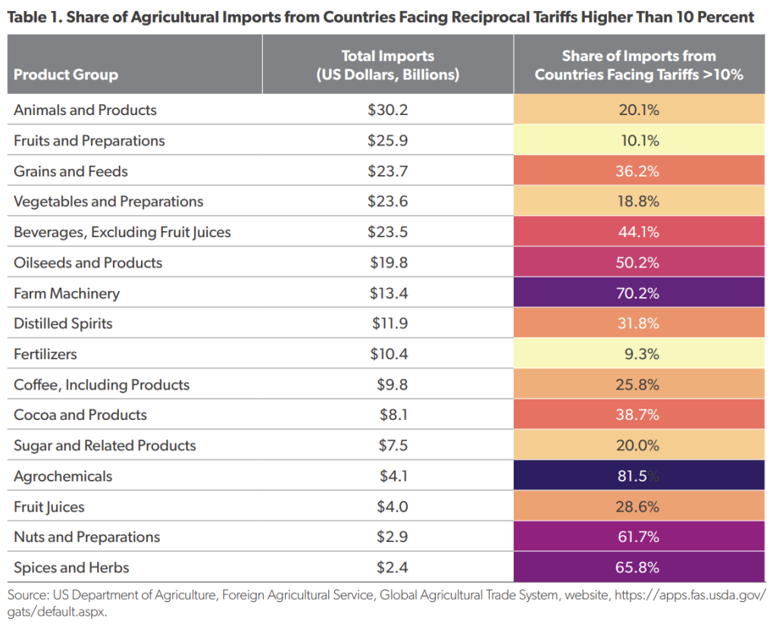

Put agriculture at the top of the list of those seeking answers. Farmers still must make plans – on what to plant, what inputs, such as fertilizer coming from Canada, are needed and available (and at what price), how to anticipate market volatility and structure the marketing plans they need to find profitability amid low commodity prices and still-high input costs.

How do farmers weather the possible loss of key export markets, especially for soybeans, right now and potentially well into the future? The U.S. currently exports approximately 50% of the soybean crop to other countries, China as the primary one.

Food manufacturers, distributors and retailers wonder about the reliability of supplies of all sorts of products, coffee, fish, spices and an extensive list of important items whose foreign origins are normally invisible to the consumer. How much of a cost increase can I absorb, and how much must I pass along to the next link in the marketing chain?

But we don’t have to panic about our fruits and vegetables as they are USMCA compliant and not subject to the new tariff rates. For example, the U.S. imports about 59% of fresh fruit and 35% of vegetables from other countries, notably Mexico, Guatemala, Costa Rica, and Canada. Well, maybe we can panic about tomatoes — now a casualty of the trade war, a 10% increase in the price of tomatoes is a possibility for the 70% of tomatoes brought in from Mexico.

What do corn, soybeans, and China have to do with tariffs?

Exports around the world are a large portion of demand for US agricultural products. They help balance the trade deficit. The U.S. has spent a lot of time and effort to expand market access. As a result, just about 65% of US soybean production is exported in the form of seed or finished products like soybean oil, soybean meal, meat, and biofuels. About 30 percent of corn is exported in the form of grain or finished products like ethanol, meat, and dried distiller’s grains feed.

The top three countries targeted for tariffs to date: Mexico, Canada, and China, are also our top three markets for agricultural exports at $30.3 billion, $28.3 billion, and $24.7 billion, respectively, in 2024.

– Betty Resnick, Economist, American Farm Bureau Federation, March 18, 2025

For agriculture, this is much about China.

Before the US-China trade war began in 2017, 40-50% of all global soy going into China was from the US and Brazil was 50%; now (2024) 20% of China’s soy comes from the US, 70% is Brazilian origin. The US has lost ground in China due to the growth in Brazil.

China’s place atop the list of countries facing the highest reciprocal tariffs has attracted extensive attention. The American Farm Bureau estimates that the cumulative tariffs imposed by China on U.S. agricultural products will climb to 71.5 percent for soybeans. As the New York Times observed, “More than half of U.S. soybean exports went to China last year, but the price just went up 135 percent under the tariffs China installed in response to President Trump’s 145 percent tax on Chinese imports.”

Relief for farmers?

USDA Secretary Brooke Rollins has been engaged with various leaders across the agricultural sector, discussing how to deal with the potentially adverse economic effects of the tariff action. Officials acknowledge the need to offer assistance, but details on just how much aid to provide, how to deliver it, and most of all how to pay for it still are under discussion.

Producers received an estimated $28 billion in financial support during the 2018 trade disputes. Officials worry that the price tag could be even higher this time around. Commodity prices remain well below estimated costs of production and input prices, while a bit lower this year, nonetheless still represent a substantial expense.

Worries about supplies of fertilizers such as potash from Canada and other suppliers also remain, despite progress in carving out some tariff exemptions. Moreover, unlike the last time around, when the dispute centered on China, the global extent of the proposed tariffs also will affect the ability to market to other customers around the world, especially many of the key traditional markets facing tariffs above 10 percent.

Some officials continue to argue that income from the tariffs will help provide additional funds, but that income has yet to be realized. Hopes to fund the economic support through USDA’s Commodity Credit Corporation (CCC) are also being discussed. But the actual amount of money available under the CCC’s $30 billion authority is still in question.

The prospect of approaching Congress for additional funds poses big political issues, as both the House and Senate work to resolve an already contentious budget blueprint – not to mention how taxpayers would respond to spending more for farm relief amid the drive for spending cutbacks and fiscal balance.

And the consumer?

The effort to address the long-standing problem of the trade imbalance won’t come without a cost to the American consumer, at least as the negotiations needed for resolution of the problem play out and global markets stabilize.

According to the political website The Hill, the Tax Foundation estimates the tariffs could result in a de facto tax increase of $1,900 for each U.S. household in 2025, unless the issue is resolved quickly. That figure includes the added cost of everything subject to the tariffs, not just food.

According to the political website The Hill, the Tax Foundation estimates the tariffs could result in a de facto tax increase of $1,900 for each U.S. household in 2025, unless the issue is resolved quickly. That figure includes the added cost of everything subject to the tariffs, not just food.

The Atlanta Federal Reserve estimates tariffs of 25 percent for Mexico and Canada on products ranging from beef, pork, grains, potatoes and canola oil (Canada) and vegetables, fruit, beverages and spirits (Mexico) could result in an increase of 1.63 percent in costs.

Threats to impose a 20.9 percent tariff on tomatoes from Mexico when the existing tomato import agreement expires in July could lead to a noticeable jump in prices, according to the Fresh Produce Association of the Americas.

While most economists seem to agree higher tariffs mean higher prices, few agree on exactly how much of an increase to expect. They point to the open question of how much of the higher costs portions of the food chain are willing to absorb and how much they feel compelled to pass along.

The answer may be some time coming, and still subject to further decisions and actions taken by the Trump Administration in refining and finalizing its trade strategy.

The Bottom Line

The international clamor over U.S. efforts to address its trade imbalance through tariffs isn’t likely to subside for some time. But unless some acceptable plan is found to deal with the issue, expect to see prices for the food and other products we import continue to rise – and American producers once again at the front lines of the conflict.

One Big Beautiful Bill for Dummies

So now that most of the political clamor has died down, what are the facts behind the Big Beautiful Bill for food producers and consumers? We burrowed through the nearly 900 pages of legislative language to find the key provisions – and found some interesting details behind the headlines and hoopla.